This Week’s Developments in the US Economy

The Potential Impacts of Tariffs on Multifamily Portfolios

Recent US tariff policies are seen by some as impacting multifamily operating costs, and thus a negative for the sector overall. Despite the near-term uncertainties about the impacts of tariffs, it may be easy for some to overlook that the fundamentals of demand for rental housing remain robust, underpinned by demographic trends and ongoing affordability pressures within housing markets.

Overall, the demand drivers for multifamily remain in place, in our view. The US is still experiencing demographic support for rentals (e.g., household formation by young adults and increasing numbers of older renter households). The job market, while cooling, is not in a recession. Wage growth, though moderating, is expected to continue to boost renters’ real incomes.[i]

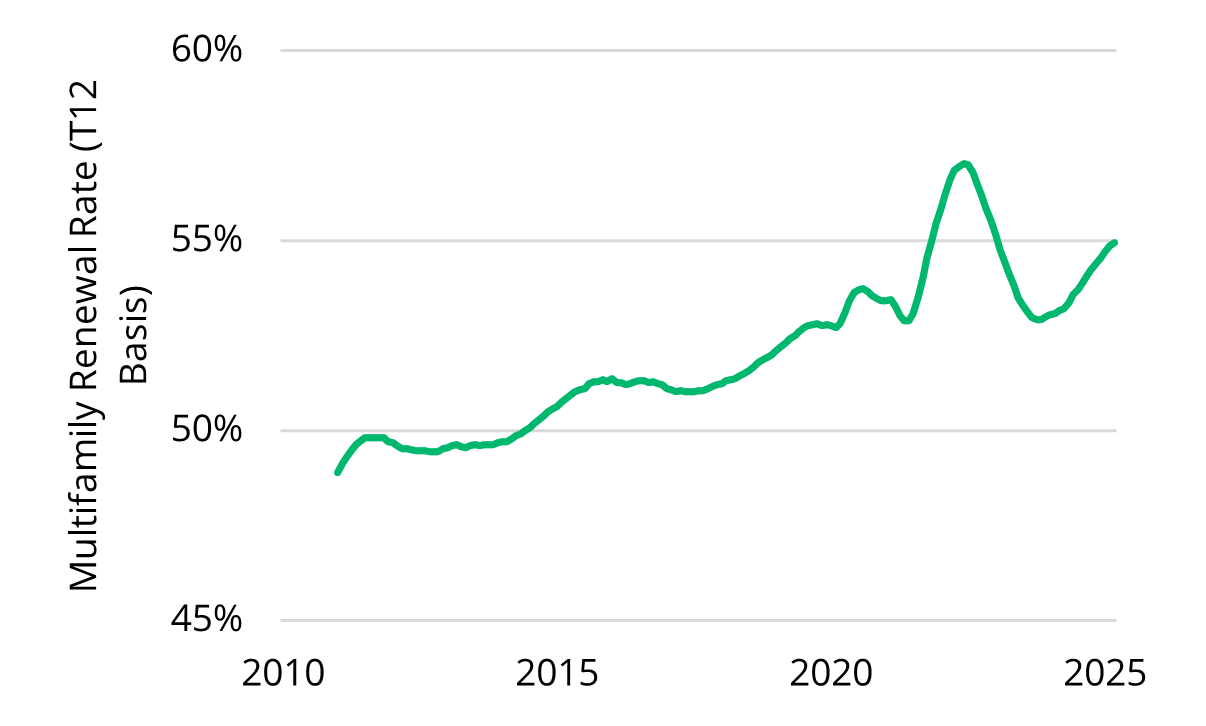

These factors suggest that the base case is not a severe downturn for multifamily, but we believe that some degree of economic softness is likely. Investors should thus view the tariff and uncertainty risks as important caution flags, but it is not our view to assume a worst-case scenario where we see a collapse in multifamily demand fundamentals. We believe that workforce and middle-income housing will likely see sustained demand—in fact, if homeownership remains expensive due to high mortgage rates, many middle-income households are likely to stay renters longer, providing a stable occupancy backdrop (see accompanying visual). The primary risk to the outlook is if an unforeseen shock (for example, a sharp tariff-induced drop in business investment or financial market instability) pushes the economy into a deeper recession than anticipated.

More Renters Are Renewing than During the Previous Cycle[ii]

Existing Properties: Emphasizing Operations to Mitigate Price Volatility

While inflation has increased operating costs and contributed to the resetting of asset values, we believe that an emphasis on multifamily operations can effectively mitigate these pressures. After operating expenses surged in 2022, we have observed a sector-wide deceleration in cost growth to only 1.0%-1.5% as of early 2025, approaching decade lows.[iii] We believe effective cost mitigation efforts have helped rein in expense growth and that multifamily operators can continue to sustain NOI growth and bolster property values, even in an uncertain policy environment. Investors recognizing the sector’s inherent strength in maintaining robust income performance can navigate current price pressures with greater confidence, leveraging operational excellence to offset volatility and uncertainty in the current environment.

For existing multifamily owners, the current environment presents a number of focal points where risk should be mitigated:

- Prolonged cost inflation and tariff-related volatility may require careful consideration of potential trade-offs—such as deferring non-critical maintenance to control expenses.

- Budgeting for continued high expenses that are unrelated to tariffs (for instance, insurance premiums now form a much larger share of operating costs).

- Continuing to navigate a financing landscape where interest rate volatility can be severe, particularly if an owner has floating-rate debt or upcoming loan maturities.

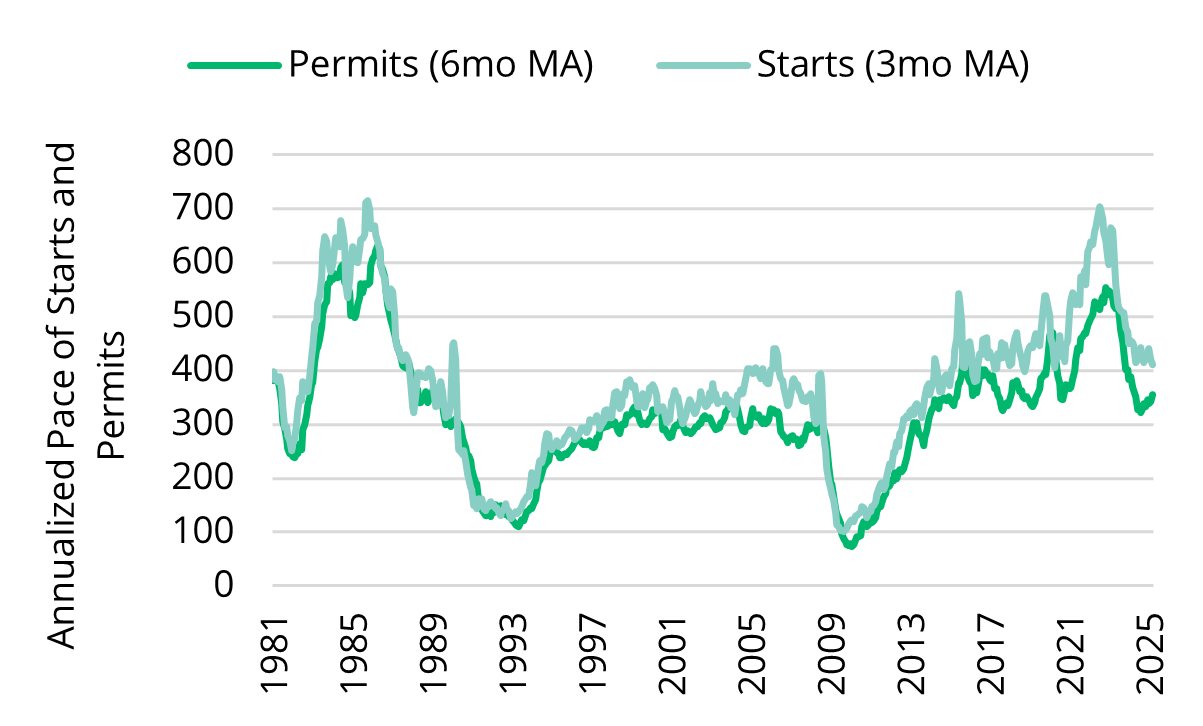

New Construction: Expect the Slowdown to Get Even Slower

Tariffs and commodity price inflation are likely to impact materially new multifamily construction by elevating development costs. Essential building materials are subject to significant tariffs—imported steel and aluminum carry a 25% duty, and recent considerations could similarly affect lumber and copper imports. Overall, construction costs in early 2025 remain nearly 40% higher than pre-pandemic levels,[iv] constraining the financial viability of many proposed projects. Highlighted below are some of the areas where we are seeing the short- and medium-term impacts of tariffs and higher construction costs:

- Multifamily construction starts and permit issuances have decreased nearly 40% since peak levels from 2022 and 2023.[v]

- From a peak of approximately 530,000 units in 2022,[vi] the pace of multifamily starts has slowed to approximately the pre-pandemic pace.

- The National Multifamily Housing Council continues to report widespread delays due to permit backlogs and cost-induced budget revisions, causing developers to pause or halt projects.

Pace of Starts Nearing Previous Cycle[vii]

In our view, the reduction in construction activity will tighten future multifamily supply, which may support rent growth in existing assets over the medium term. In the short term, project feasibility remains challenged, and developers increasingly require higher yield thresholds to justify initiating new developments amidst uncertainty in both costs and future market conditions.

Operational Risks and Economic Uncertainty

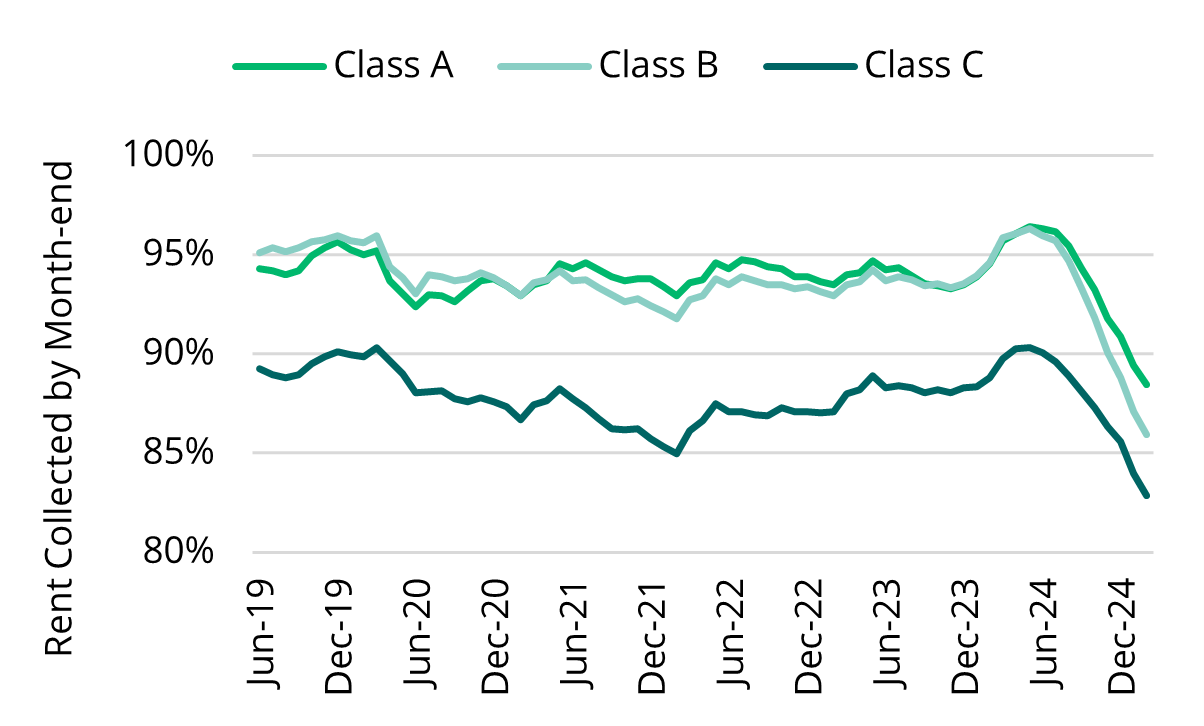

Across multifamily segments, there are several operational risks that we believe warrant tracking. As rent collections have deteriorated across multifamily segments after several years of stability according to RealPage (see accompanying visual), these risks are focal points for monitoring:

Rent Collections by Class Cut[viii]

- Financial pressure on tenants remains a concern. Nearly half of US renter households are cost-burdened, spending over 30% of their income on housing, leaving minimal margin for rent increases or broader inflationary pressures. Inflation in consumer essentials—in part exacerbated by tariffs—could further reduce renters’ disposable incomes, potentially weakening rent collections, especially in workforce housing segments.

- Employment stability among tenants also demands attention. While the US unemployment rate remains relatively low at around 4.2% as of early 2025, forecasts indicate potential softness ahead as the economy slows under the weight of higher interest rates. Job sectors prominent among renters—including retail, hospitality, manufacturing, and construction—remain particularly vulnerable to cyclical downturns exacerbated by tariffs and retaliatory measures affecting employment.

To mitigate these risks, multifamily operators should be increasingly focused on maintaining occupancy and tenant stability, potentially through moderated rent increases or proactive tenant engagement strategies—collectively, all are critical for sustaining NOI in a volatile economic environment.

Peering Through the Noise to See Value

Current tariff policies and broader economic volatility present several operational and financial challenges for US multifamily investors to navigate. Tariffs contribute to cost inflation and uncertainty, impacting everything from a landlord’s utility bill to the price of a new roof, and they complicate new construction underwriting. Even higher interest rates and volatility—partly a byproduct of inflation and policy responses—could contribute further to the repricing of assets, and in particular for development due to higher yield requirements. Meanwhile, slower growth and potential upticks in unemployment raise caution around tenants’ ability to pay rent and absorb future rent increases. By focusing on operational efficiency, tenant retention, and prudent capital management, we believe that multifamily investors can navigate this period of uncertainty.

As the long-term fundamentals of rental housing demand remain intact, we believe that peering through the noise in the near-term requires a conservative and informed approach as the market works through the implications of tariffs, inflation, and economic moderation.

[i] Fannie Mae, Multifamily Economic and Market Commentary, January 2025. Accessed 4/14/2025. Available at https://multifamily.fanniemae.com/news-insights/market-research-commentary

[ii] RealPage, as of March 2025.

[iii] RealPage, as of March 2025.

[iv] Moody’s Analytics, Engineering News Record (ENR) Building Cost Index as of April 16, 2025.

[v] Bloomberg, US Census Bureau and the US Department of Housing and Urban Development as of April 15, 2025. Starts and permits are measured on a six-month and three-month moving average, respectively.

[vi] RealPage, as of March 2025

[vii] Bloomberg, US Census Bureau and the US Department of Housing and Urban Development as of April 15, 2025. Starts and permits are measured on a six-month and three-month moving average, respectively.

[viii] RealPage, as of April 15, 2025.