This Week’s Developments in the US Economy

The Evolving Profile of US Rentership

Housing emerged as a central issue during this fall’s election, drawing renewed attention to challenges within the US housing market. In many respects, there is not enough housing that is attainable from an income perspective. A key reason is that, after more than a decade of underbuilding, the US continues to face a structural imbalance in housing supply. At the same time, the profile of US renters has expanded meaningfully since 2010, becoming more diverse and encompassing a boarder range of demographics than in decades past. We believe this evolving renter profile creates sustained tailwinds that will drive long-term demand, extending well beyond the current period of elevated supply.

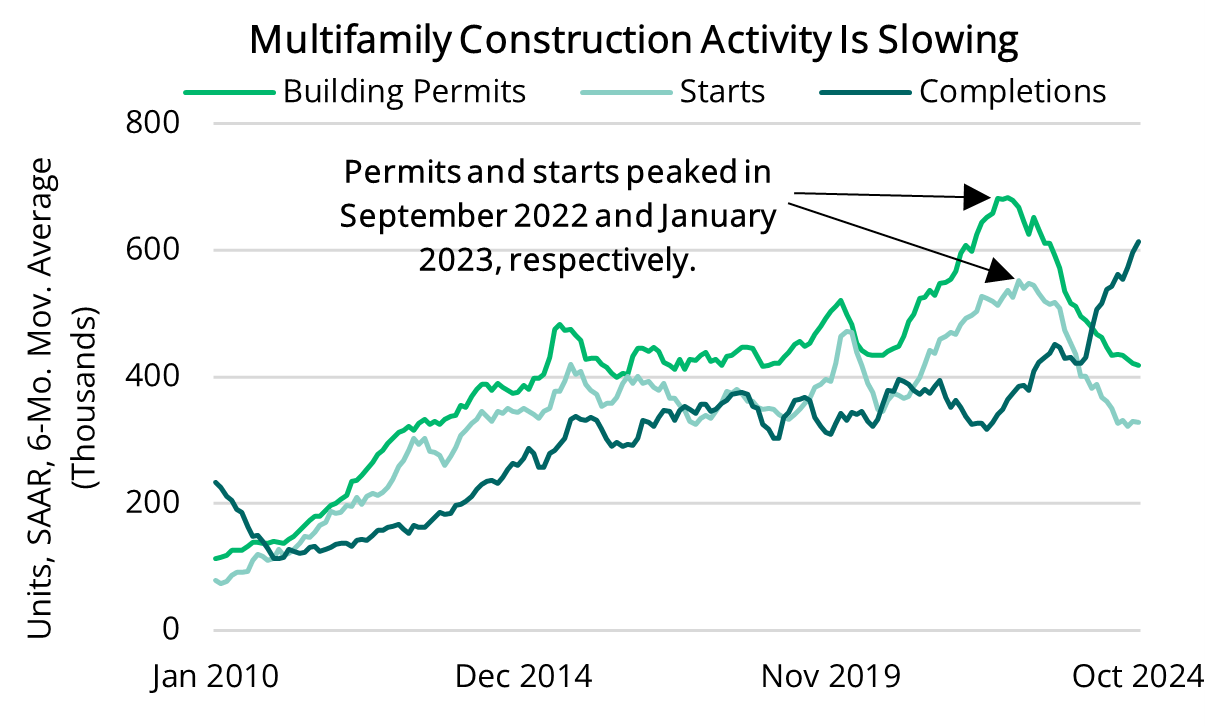

The housing shortage remains a concern, underscored by recent Census construction data indicating a slowdown in multifamily construction after multiple quarters of elevated supply. While multifamily completions, as measured by three- and six-month moving averages, continues to rise, a decline in permits and starts—key leading indicators of completions—signals a shift in the pipeline. The rental market thus finds itself at a critical juncture, shaped by persistent supply imbalances and evolving demand dynamics.

Over the past few years, the rental landscape has been transformed by a growing number of renter households and an increasingly diverse renter demographic. Significant growth has occurred across cost-burdened households, affluent renters, and aging adults choosing to rent, each contributing to a more complex rentership profile. These trends highlight the need for housing options that cater to a wider range of financial capacities and lifestyle preferences, which we believe will shape the next cycle.

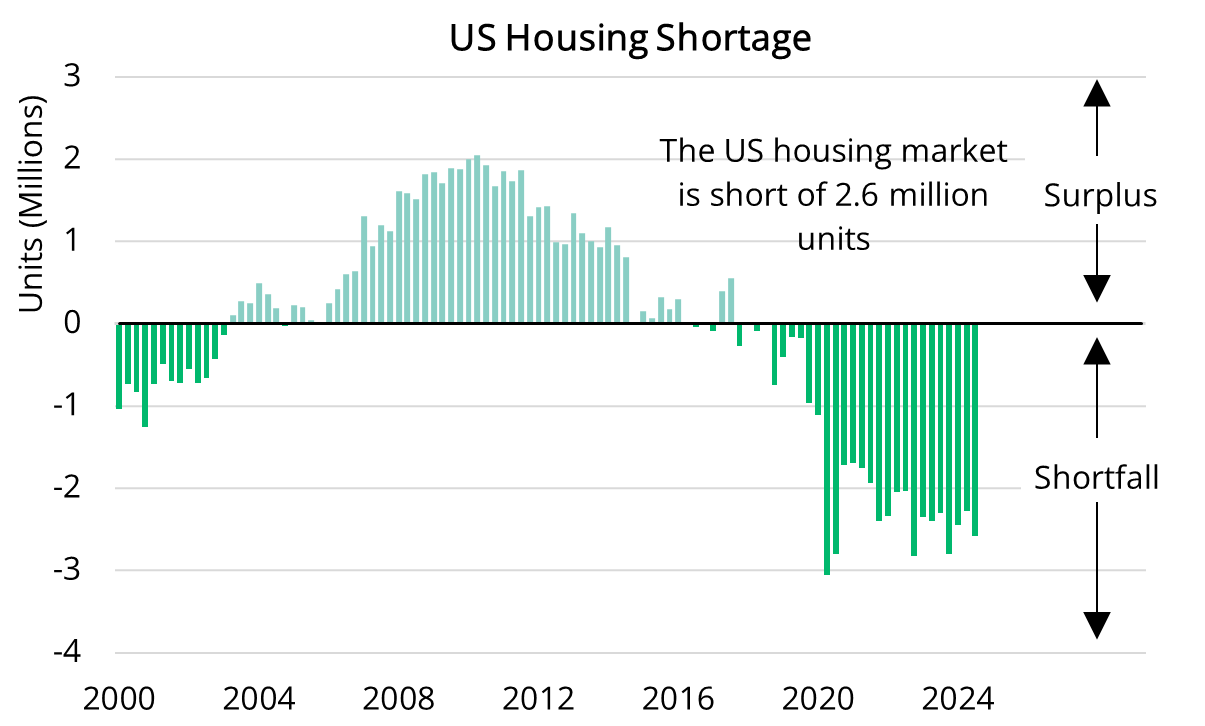

The Implications of a Deep Housing Shortage

Our internal analysis highlights a significant shortfall in the US housing market, and our baseline estimate suggests a deficit of 2.6 million units needed to restore market balance. However, this figure likely understates the depth of the shortage, as it does not account for the additional housing required to support new household formation. We believe this latent demand could accelerate if affordability challenges subside in the coming years, further exacerbating the supply gap.

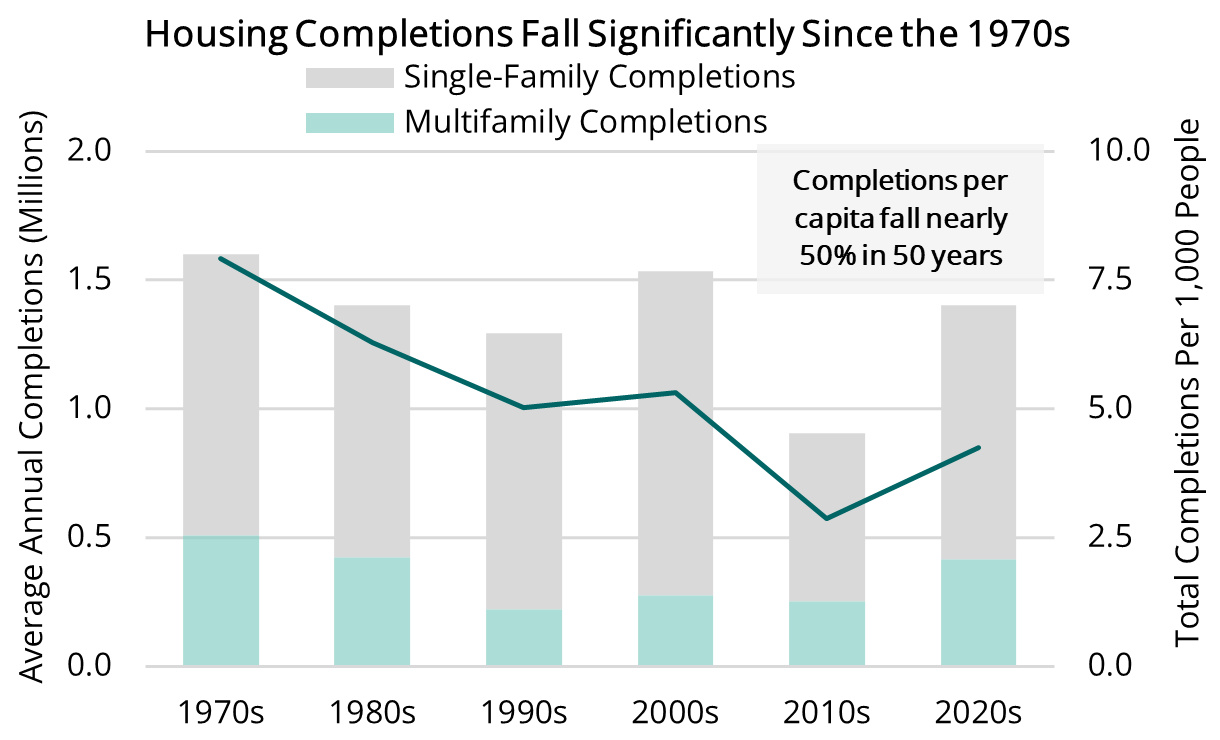

For context, annual housing starts have averaged just over 340,000 units since 2010, which is well below the 450,000 annual starts seen from 1960-1990, despite a significantly larger U.S. population today. Several factors suggest that this housing deficit, and particularly the affordability shortage, is likely to persist as years of construction have skewed toward higher-end apartments and larger single-family homes. As a result, housing affordability has eroded to historic lows with an elevated number of adults living with parents or non-relatives. Additionally, the pace of household formation is depressed compared to historic trends, underscoring the structural imbalance in the market. In reality, there are no short or easy fixes—addressing these challenges is likely to require a long-term strategy for housing supply and affordability initiatives.

But What about All the New Construction?

Despite the overall housing deficit, the rental market currently faces temporary imbalances between elevated supply and demand. Since Q4 2023, over 550,000 multifamily units have been delivered—the largest four-quarter total in 24 years. However, housing completions per capita remain below levels observed from 1970 to 2010, and vacancy rates are stabilizing, underscoring the continued structural imbalance in the market.

Looking ahead, we expect rental demand to grow while supply expansion slows. Since 2020, the renter pool has grown by over two million households, but multifamily construction activity has slowed meaningfully since interest rates rapidly increased. Permits and starts have both fallen below their pre-pandemic averages (2014-2019) and are now nearly 50% below their respective peaks in early 2023 and 2022. As of October, multifamily permits and starts posted year-over-year declines of 21% and 13%, respectively, underscoring a notable slowdown in new construction

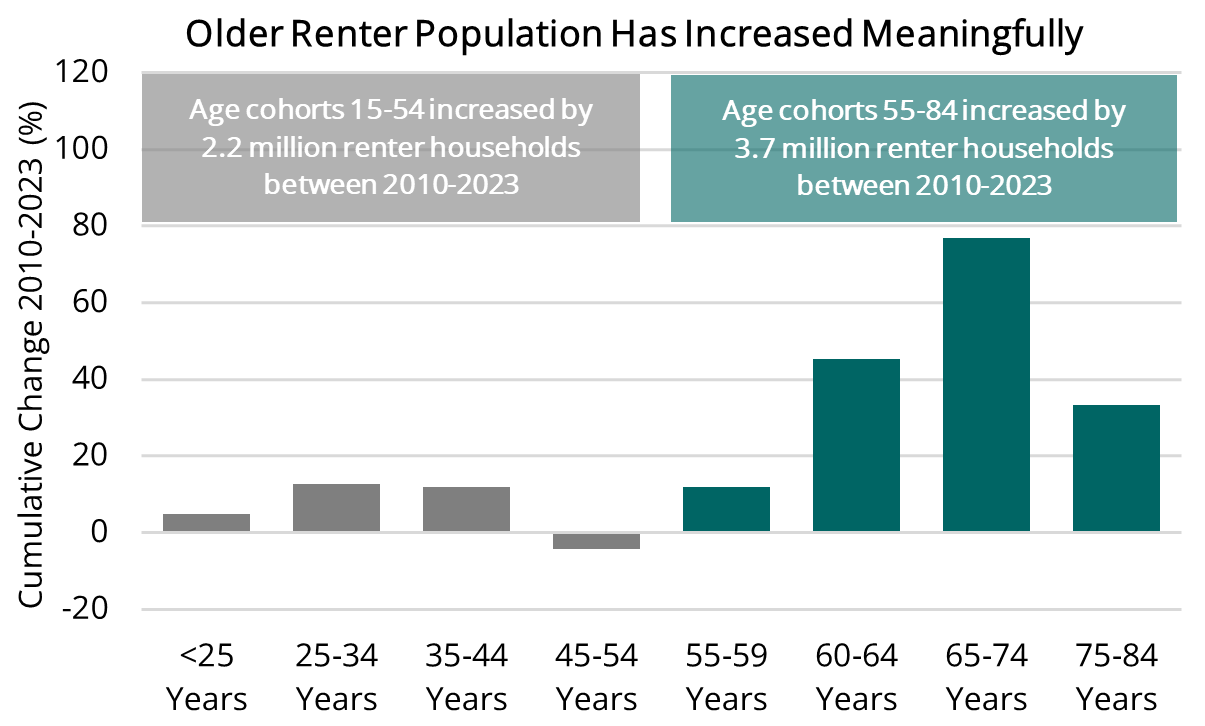

This deceleration suggests that new inventory may be more easily absorbed in key markets, driven by demand from three primary renter segments: older adults, affluent households, and cost-burdened households. These groups reflect a more diverse and dynamic renter demographic that is reshaping the housing market and driving sustained demand.

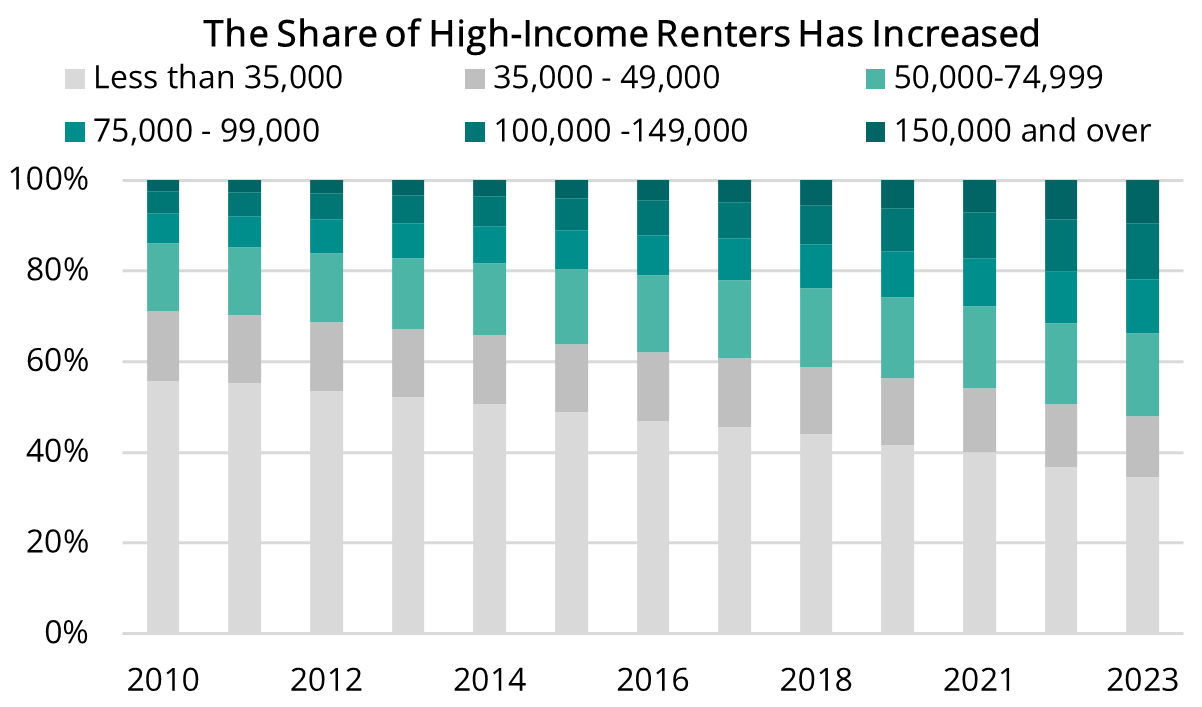

Growth Across Higher-Income Renters

A significant driver of rental demand is the expanding presence of higher-income households in the renter pool. Record-high home prices, elevated mortgage rates, and limited inventory have made homeownership less accessible, compelling many of these households to rent instead. We see this trend as particularly pronounced in high-cost, high-barrier markets, where renting often becomes a necessity rather than a preference. Between 2020 and 2023, the number of renter households earning over $75,000 has tripled, with notable growth in the over-$100,000 household segment. We believe that this shift could stabilize rents in top rental markets.

Older Adults Opting to Rent

The rental market has also experienced a significant increase in older adults opting to rent, which we believe is driven by both evolving preferences and, in some cases, necessity. Renters aged 55-84 have increased by 42% since 2010, far outpacing the 7.4% growth seen among younger cohorts. This trend likely reflects a combination of factors, including the desire for flexibility and low-maintenance living, downsizing and financial considerations, and the growing availability of amenity-rich rental housing designed to meet their specific needs. As this demographic has captured a larger share of the rental pool, we believe that it highlights the importance of tailoring rental offerings to align with evolving lifestyles and priorities.

The Continuing Affordability Challenge

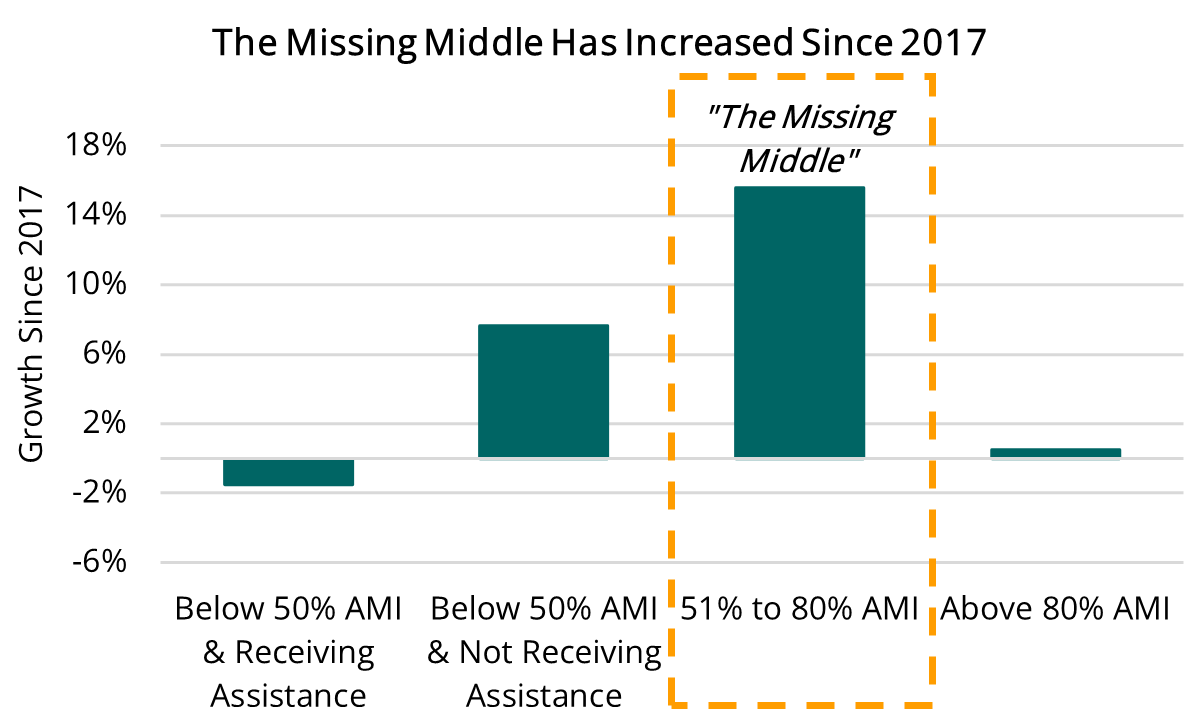

Affordability continues to be a widespread issue for renters across all income levels and ages. Between 2021 and 2023, over half a million households became cost-burdened, paying more than 30% of gross income on housing costs, bringing the total to nearly half of all renters. Many of these households fall into the "missing middle"—those that earn too much to qualify for subsidized housing but are unable to afford market rents. Even higher-income renters are struggling, with nearly a quarter of those earning $80,000-$100,000 now cost-burdened, up from 13% in 2019. In our view, addressing affordability requires scaling up housing rehabilitation and new, affordable construction—efforts that have not kept pace with demand.

Outlook for the Residential Sector

By understanding these evolving trends, we believe it will be possible to identify solutions that prioritize affordability, cater to a diverse and dynamic renter base, and respond to changing market conditions—all of which will play a critical role in shaping the future of the housing sector and fostering long-term market resilience.