This Week’s Developments in the US Economy

SLOOS Points to Further Tightening Credit Conditions Ahead Across Real Estate Sectors

A recent uptick in housing starts may paint an optimistic picture on the surface, but tightening credit conditions appear to have an increasing impact on residential construction, which is likely to further decrease supply. Insights from the Fed’s Senior Loan Officer Opinion Survey (“SLOOS”) released this week aligns with the National Multifamily Housing Council’s (“NMHC”) June 2023 NMHC builder survey, and both suggest an impending slowdown in for single-family homes and all segments of commercial real estate. In addition, we anticipate the potential for disruption in residential mortgage markets created by Basel III “endgame” reforms, which could negatively impact the affordability and attainability of housing when combined with already stringent lending conditions. We examine further the current state of construction activity and how the implications of multiple factors are likely to affect activity in the near future.

State of the Residential Sector

The second quarter of 2023 saw a significant drop in approved multifamily projects, plunging 49.8% YoY, amounting to just 70,500 units. At the same time, housing starts fell a steep 62.6% from their prior peak in Q2 2022. These trends largely follow the Fed’s aggressive monetary policy tightening cycle. Interestingly, amidst this housing market tumult, a glaring shortage of available single-family homes for sale should serve as a catalyst for construction activity. However, despite a brief uptick in starts observed in May, a closer look at the six-month moving average reveals a contrasting picture, with multifamily housing starts contracting by 10% and single-family starts dipping a considerable 21% from their earlier peak.

Apartment Builders Are Experiencing Challenges

In the NMHC quarterly survey, builders reported increasing delays in project starts due to mounting economic uncertainty and feasibility issues. Notably, there has been a marked increase in the lack of construction financing, significantly contributing to delayed starts—with nearly two-thirds of survey respondents citing financing availability and economic feasibility as principal hindrances to timely project commencement.

Lenders See Conditions Tightening Even Further for Real Estate

The late July iteration of the SLOOS paints a grim picture from a lenders' perspective. Over Q2, lending standards for Commercial Real Estate tightened across various lenders—with almost three-quarters of respondents confirming tighter standards for construction and land development loans. Tighter conditions are occurring across sectors with 64.5% of lenders implementing stricter standards for loans secured by multifamily properties and 66.7% doing the same for other Commercial Real Estate assets. Single-family mortgages are also seeing tightening conditions across the board as an increasing number of banks are modifying their standards for different mortgage categories.

Will Regulatory Reform Result in More Tightening on the Horizon?

Proposed rules related to the implementation Basel III reforms present a potential for charging banks higher capital requirements for residential mortgages while increasing the number of banks subject to future regulation. This could intensify the lending environment, prompting major banks to assign higher risk weights to residential mortgages, which could meaningly impact mortgage interest rates.

We see the confluence of these factors as likely to amplify future supply constraints, placing upward pressure on rents and home prices alike.

This Week’s Developments in the Global Economy

CRE Prices Fall Across the Euro Area Amid Continued Tightening of Monetary Policy

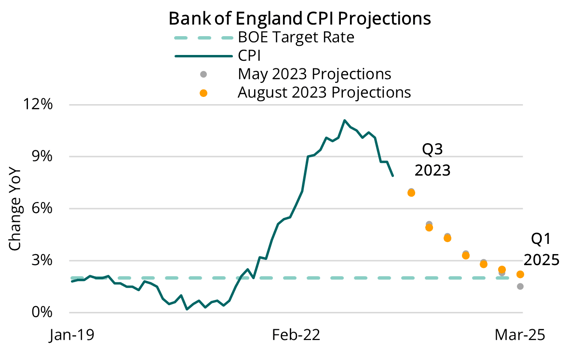

While June saw the UK's headline and core inflation figures cool slightly, inflation remains elevated at 7.9% and 6.9%, respectively. We believe persistent inflationary pressures are likely to lead the Bank of England (“BOE”) to be the first major central bank to start raising rates and the last one to stop—its own quarterly projections anticipate that inflation is unlikely to hit a 2% target until early 2025. As the pace of interest rate hikes in the UK closely follow the European Central Bank (“ECB”), we are seeing how the tightening of monetary policy continues to weigh on European commercial real estate (“CRE”) prices broadly across sectors.

This week the BOE faced another interest rate decision, and market observers were split as to whether the BOE would hike 25 or 50 bps. Ultimately the BOE announced a quarter-point hike, taking the bank rate to 5.25%, while cautioning that monetary policy could remain restrictive for some time. Like other central banks, little has been offered in terms of forward guidance, which is likely to contribute to uncertainty around the pricing of risk assets. And despite the collateral damage to various sectors of the UK economy, we anticipate that continued inflation pressures from wage growth and rising prices is likely to result in an additional hike at the BOE’s next meeting in September.

Putting a finer point on the potential implications of ongoing tightening, the European Banking Authority’s (“EBA”) 2023 stress test highlights expectations that CRE price correction will extend further. The EBA assumed a 16% decrease in 2023 and a cumulative 29% decline between through 2025. So far this year, Green Street’s Pan-European Commercial Property Index finds a 7% drop, with same-store pricing down 21% from the peak in May 2022. Accordingly, some market observers argue that the EBA’s figures may not be conservative enough, underestimating risks derived from rate hikes and tighter financial conditions.

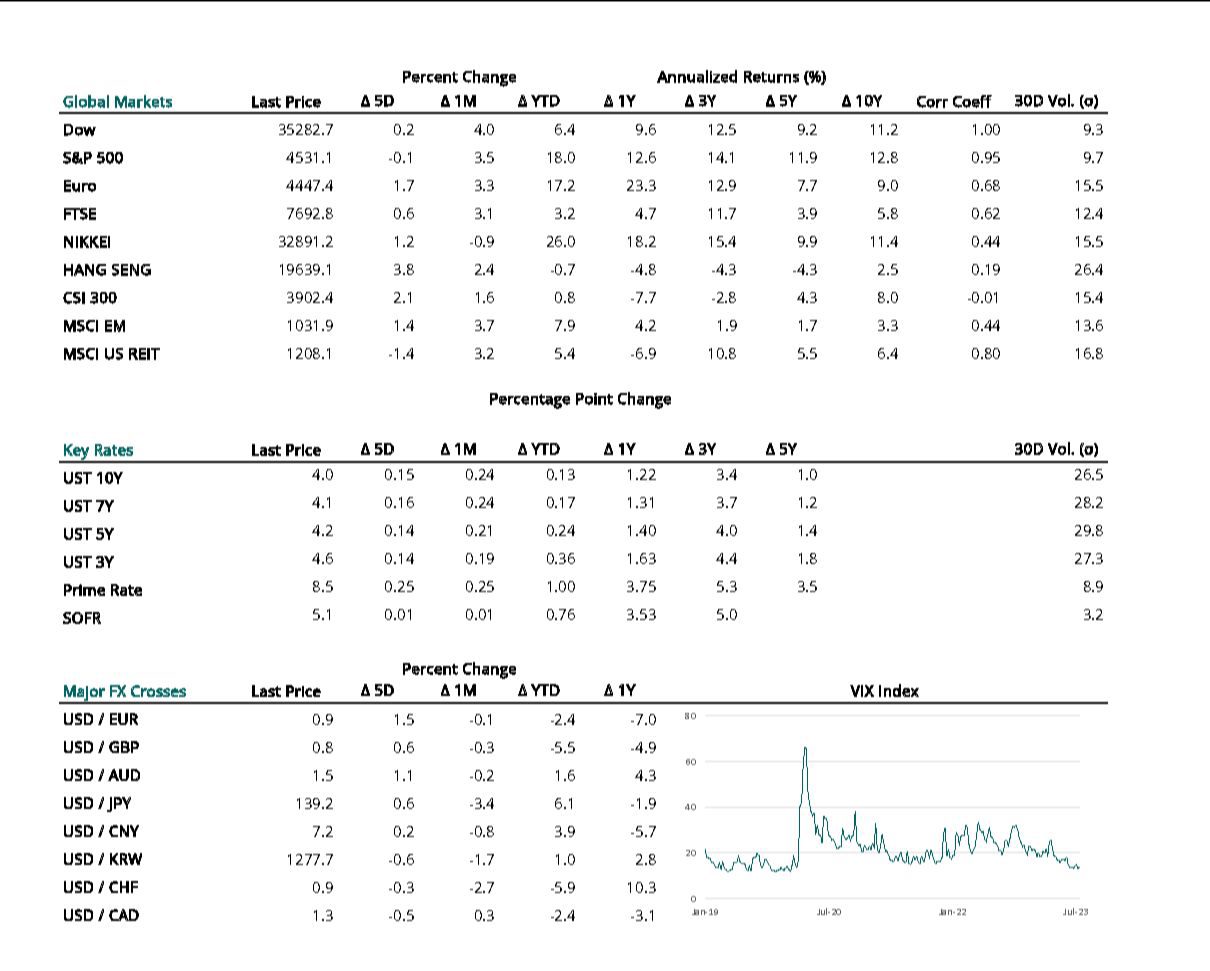

Market Rates, Catalytic Indicators, and the Week Ahead