This Week’s Developments in the US Economy

Navigating Market Volatility: Why Private Real Estate Offers Stability Amid Public Market Turbulence

We believe volatile market and macro conditions warrant evaluation of private US real estate exposure, ensuring portfolios are effectively positioned to weather near-term volatility while capturing long-term value. The announcement of sweeping US tariffs, which surprised many market observers both in magnitude and breadth, created substantial public market volatility. While the long-term ramifications on US markets will not be known for some time (nor will the extent of retaliatory measures by trade partners), we focus on the implications and value proposition for private US real estate.

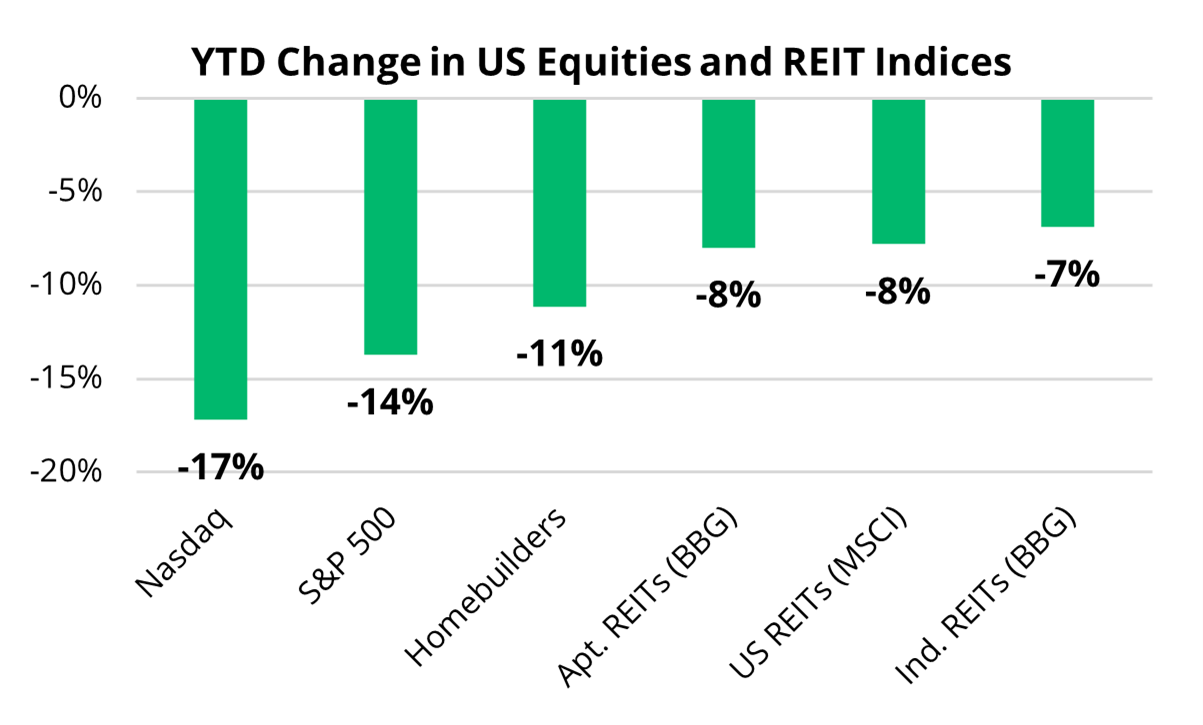

Clearly, the investment landscape has changed—US public equities are down 14% and 17% YTD for the S&P 500 and the Nasdaq, respectively, and investors have piled into US Treasuries, sending yields on the 10-year down nearly 60 bps since the start of the year.[i] Public real asset indices have fared better in the short term—a trend which we believe will continue—with home builders down approximately 11%, and US REITs showing better resilience overall, down 7-8% across our high conviction sectors (see accompanying visual).[ii]

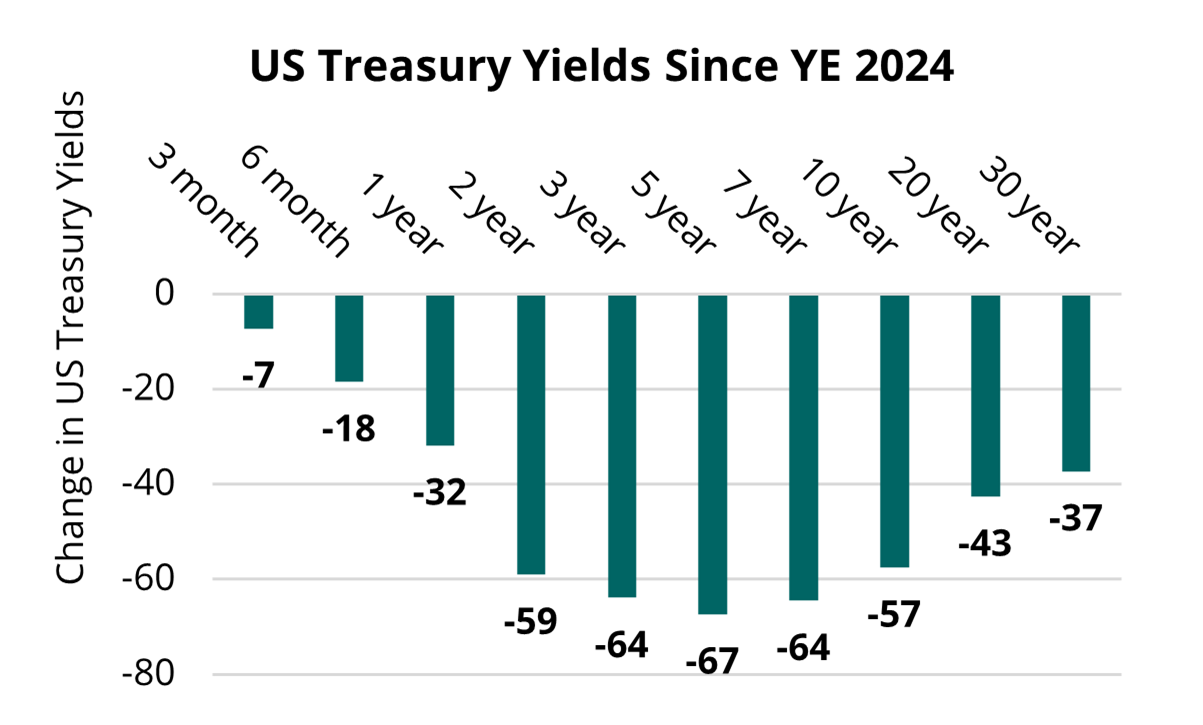

Much of this market dislocation occurred in the last couple of trading days, but we believe that the effects of US tariffs are likely to be long-lasting. The key areas of concern include persistent inflation, deteriorating consumer and business confidence and decelerating economic growth. While public real estate markets have exhibited volatility, we believe that private real estate should continue to show greater resilience on an absolute and relative basis. Private real estate has historically had lower correlation to public equities, and with flight-to-quality shifts to US Treasuries (which are typically benchmarks for fixed-rate real estate debt), we see the potential not only for asset values improving meaningfully but also increasing momentum from a deal volume perspective (see accompanying visual). Overall, we see declining yields as one of several points that underscore private US real estate’s ability to stabilize portfolios, providing the potential for current income and meaningful downside protection during turbulent periods.

Simply, we believe that tactical, near-term allocations of capital toward quality private real estate assets can achieve multiple benefits, including but not limited to: increased portfolio stability amid market turbulence; and the opportunity for attractive risk-adjusted returns as broader market conditions stabilize and opportunities emerge in the early innings of a new real estate cycle. (To view our generalized portfolio analysis pre-market volatility, please see our Private Markets 101 page at bridgeig.com/education)

Real Estate Investing Amid Volatility: Public vs. Private Markets

Public US real estate has proven acutely sensitive to daily fluctuations in market sentiment and broader equity volatility, which is true not only of the current period but extending through early COVID disruptions. This sensitivity stems from immediate liquidity pressures, investor redemptions (including in some non-publicly traded, open end REITs), and rapid repricing mechanisms in publicly traded markets. Particularly for US REITs, recent volatility in public equities has translated directly into increased price swings and valuation instability, resulting in asset values detached from underlying real estate fundamentals.

In contrast, private US real estate markets remain modestly insulated from daily equity market turbulence. A crucial difference between public and private real estate is that valuations in private markets are fundamentally driven by asset performance—such as occupancy rates, rental income stability, tenant quality, effective operations, and local supply-demand dynamics. Additionally, quarterly appraisal cycles provide a smoothing effect, limiting the effects of short-term volatility on asset values and shielding investor portfolios from irrational or liquidity-driven market movements.

We believe private US real estate provides attractive characteristics that are not present in public markets, which include but are not limited to income stability, tangible asset backing, and inherent inflation-hedging capabilities.

Our High Conviction Areas of Private US Real Estate Equity and Credit Strategies

Residential Rental: Persistent Demand and Resilient Fundamentals

Residential rental real estate (i.e., urban apartments, suburban multifamily, workforce and affordable housing, single family rentals, etc.) continues to benefit from long-term structural factors, notably a structural long-term shortage of US housing and persistent affordability challenges that support rental demand. Although declining consumer confidence may moderate short-term rent growth, the fundamental strength of residential rental properties includes: stabilizing and, in some markets, rising occupancy rates, which improved at the end of the year to finish at nearly 95% for stabilized properties;[iii] a limited pipeline of new developments due to elevated construction costs and financing challenges; and demand tailwinds characterized by strong employment growth and strengthening demographics.

Logistics Infrastructure (Industrial): Structural Strength Amid Moderating Growth

The attractiveness of US logistics real estate remains well-anchored by secular trends, including continued e-commerce adoption and ongoing supply chain optimization. Although moderating consumer spending poses a short-term headwind, industrial properties benefit from stable long-term tenant relationships and relatively inelastic demand for strategic locations, particularly urban infill last mile logistics. As tenant demands evolve, we see supply chain advancements as a net positive for the industry, occurring in a virtuous cycle: more efficient supply chains as a function of more efficient and quicker-to-customer deliveries, which leads to better margins and profitability, which in terms leads to more growth and demand for space.

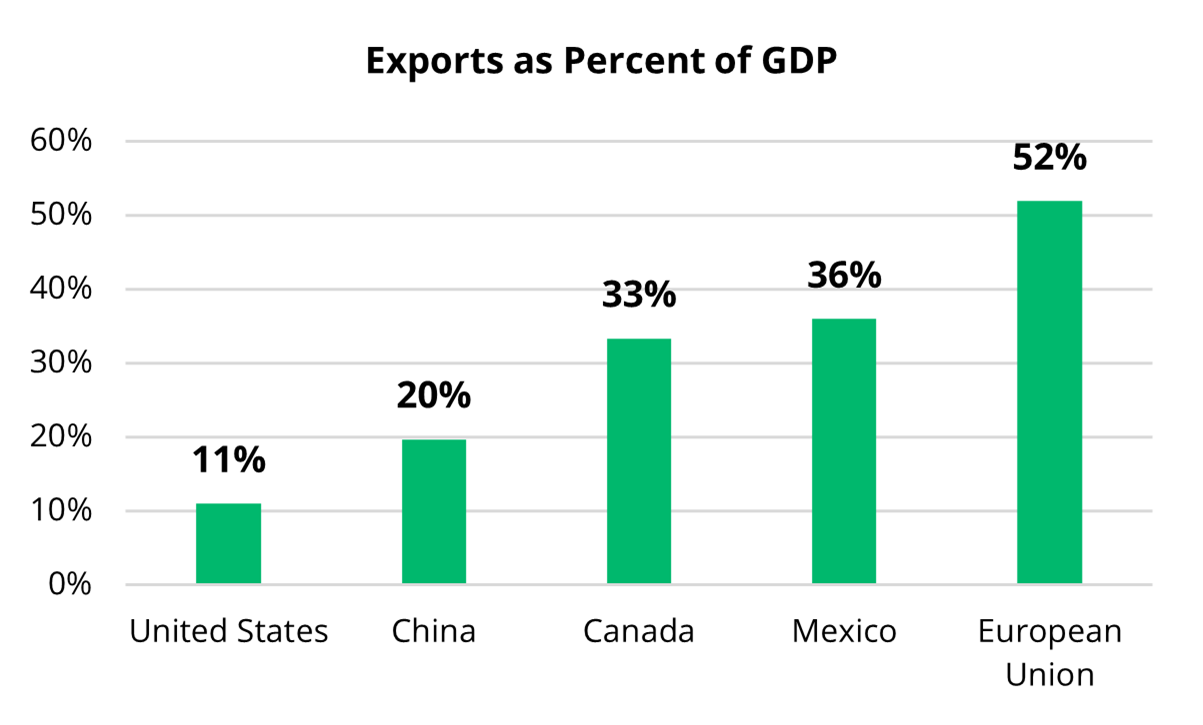

We anticipate US tariffs to have a measurable but manageable effect on established supply chains and trade routes. We see the greatest likelihood for short-term disruptions (as opposed to longer-term issues) as US supply chains are better positioned than global trading peers to evolve around tariffs (see accompanying visual).[iv] Specifically, we see the potential shift away from Mexico/Canada—at least during the anticipated renegotiation of the USMCA—to ASEAN and India supplies, which is expected to put more pressure on occupiers to be in US Coastal Gateway markets. Coupled with dwindling supply, we expect superior fundamentals in these markets.

We believe industrial logistics infrastructure can provide inflation-limited income streams by seeking quality logistics assets near critical urban markets and established infrastructure corridors, which are essential to providing ongoing support to supply chains, which are expected to see moderate recalibration amid international trade turbulence.

Positioning for Stability and Future Opportunity

Amid heightened macroeconomic volatility, we believe that private US real estate can serve as a stabilizing force.

i Bloomberg as of April 5, 2025 (SPX and NDX Indices).

ii Bloomberg as of April 5, 2025. Reference indices are for homebuilders (SPDR S&P XHB US), MSCI US REITs (RMZ), Bloomberg Apartment REITS and Industrial/Warehouse REITs (BBREAPT and BBREINDW).

iii RealPage as of Q4 2024.