This Week’s Developments in the US Economy

Coalescing Trends in the Economy and the Year Ahead

With the end of the year approaching, the outlook for the coming year comes into clearer focus—not just because 2024 is fading but also due to consistent trends emerging throughout the US economy. The US has experienced steady growth, inflation is lower but a little warmer than anticipated, and the labor market has cooled and stabilized. While the labor market continues to display stability, we see not only a firmer case for a December interest rate cut, but also a stronger case for additional cuts in 2025 as we assess labor market data that is often overlooked. We believe the Quarterly Census of Employment and Wages (“QCEW”) may give further support for additional interest rate cuts as the QCEW data suggest lower hiring levels than monthly Bureau of Labor Statistics (“BLS”) data. As the Fed balances its dual mandate of price stability and maximum employment, the QCEW offers important insights into actual employment conditions that might respond positively to lower rates in support of sustained economic growth.

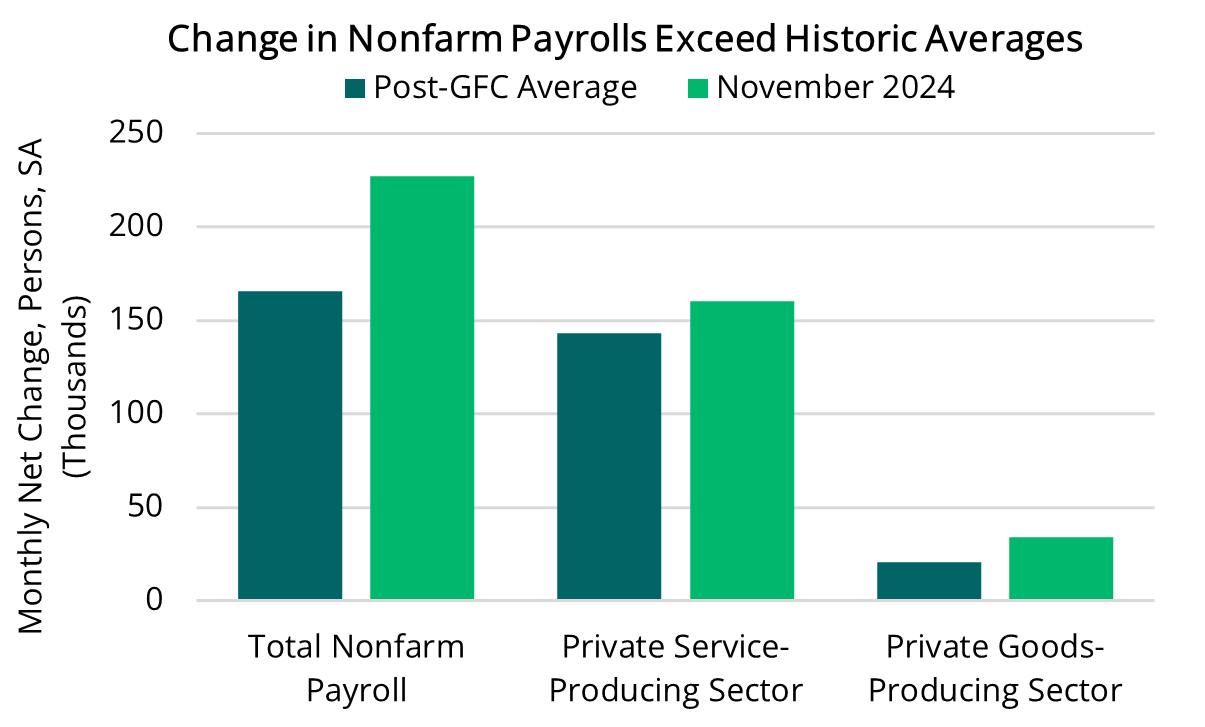

Stability, but Potential Overstatement of Employment Levels

A positive trend has been the stability and breadth of monthly hiring across sectors. And while US employment levels have risen over the past several years, the BLS monthly data may be overstating the magnitude of the increase (see accompanying visual). Potentially signaling what is influencing the path forward, Fed Chair Powell has noted that while the labor market is near full employment, monthly employment figures could be inflated due to factors like the birth-death model, which estimates job creation from new businesses and losses from closures.

While monthly data offers timeliness, the quarterly QCEW, though lagged, provides a more accurate and comprehensive insight into hiring trends. Derived from quarterly reports of about 10 million US establishments under Unemployment Insurance (“UI”) laws, QCEW captures over 95% of jobs at detailed geographic and industry levels. In contrast, the monthly Current Employment Statistics (“CES”) survey, though largely derived from the same quarterly UI data, relies on a sample-based approach covering roughly 119,000 businesses and 629,000 worksites, which results in estimates rather than accurate counts. Additionally, due to the quarterly cadence of the UI data the CES sample alone cannot provide an accurate estimate of total monthly employment as it fails to capture new businesses. This is where the birth-death model comes into play, introducing another layer of estimation which could be contributing to the data discrepancy. In June, for example, private sector employment was reported at 135 million by CES but at 133 million by QCEW, indicating that quarterly employment data is showing softer hiring trends than monthly estimates.

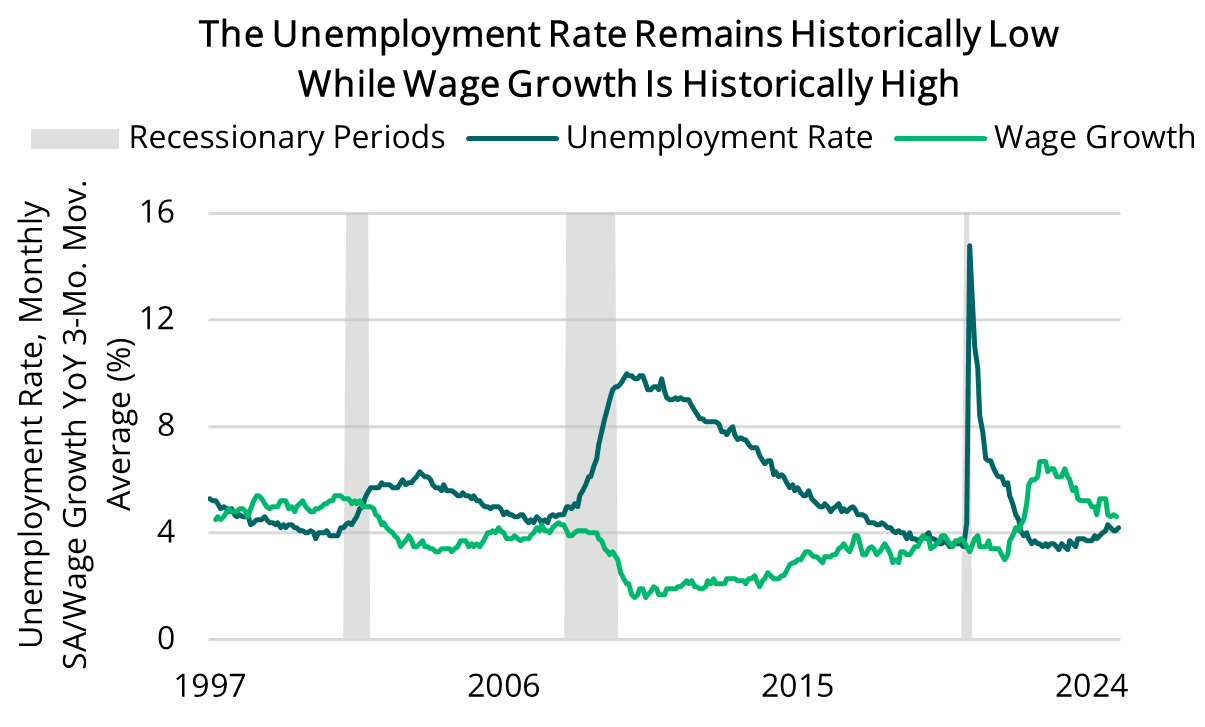

Labor Market Stability

While hiring may not be as robust as monthly data suggests, the overall health and condition of the labor market remain favorable. The labor market continues to demonstrate structural stability and wage growth continues to be robust (see accompanying visual), providing a solid foundation for gradual economic growth as well as demographic- and consumer-driven segments of the economy. Historically low unemployment rates and balancing supply-demand dynamics are helping to contribute to a stable environment and an improving outlook for 2025.