This Week’s Developments in the US Economy

Coalescing Trends in the Economy and the Year Ahead

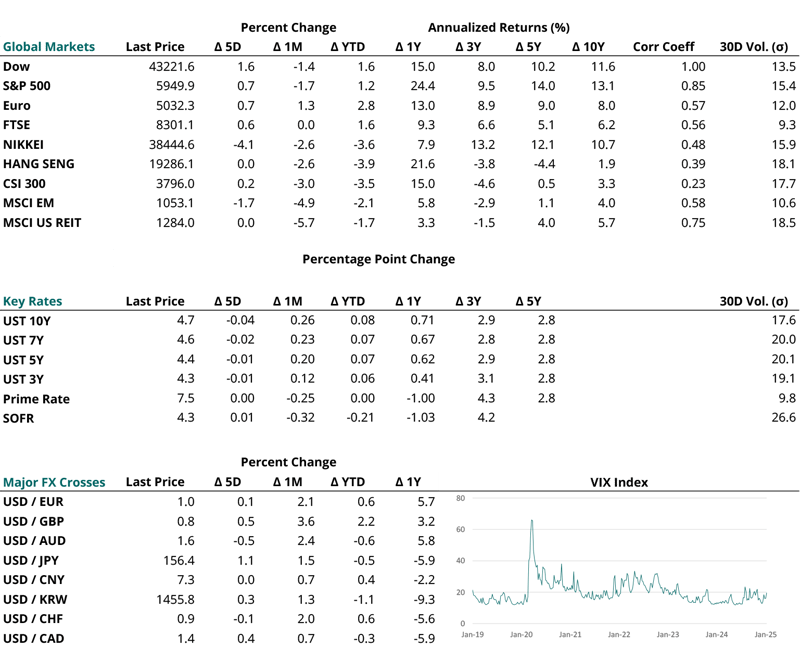

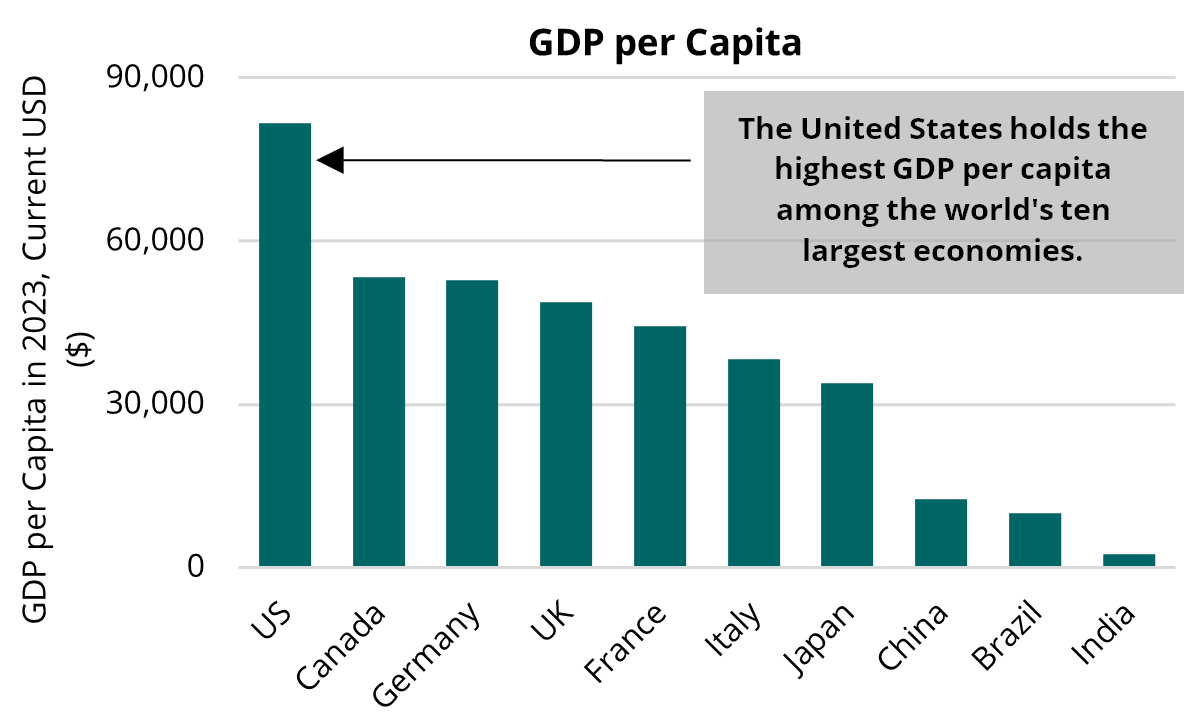

As 2025 unfolds, the US economy continues to surprise markets for its stability and growth amidst a landscape of global economic turbulence. Among the world’s largest economies, the US leads in GDP per capita (see accompanying visual) and maintains one of the strongest 2025 growth forecasts. Despite the dual challenges of elevated interest rates and persistent inflation, this solid economic foundation positions the US to better absorb global shocks, which reinforces the conviction for US private markets in offering safety and quality on an absolute and relative basis.

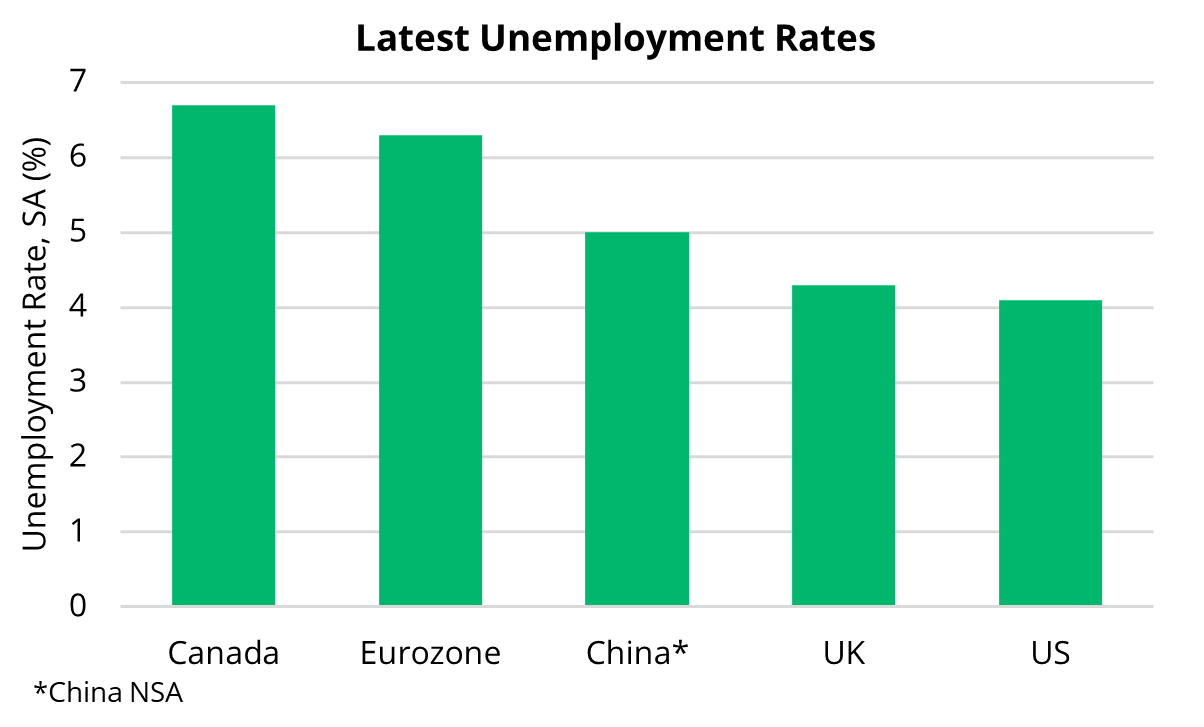

While the US builds upon its economic momentum, global peers face mounting headwinds. Canada’s economy is constrained by soft growth and political uncertainties, the UK and Eurozone struggle with persistent inflation, sluggish economic growth and similar political uncertainties, and China grapples with structural vulnerabilities that undermine long-term potential growth. The widening economic gap underscores the narrowing opportunity set for capital markets, in our view, and in this week’s Note we review the evolving challenges in key global peers and trading partners.

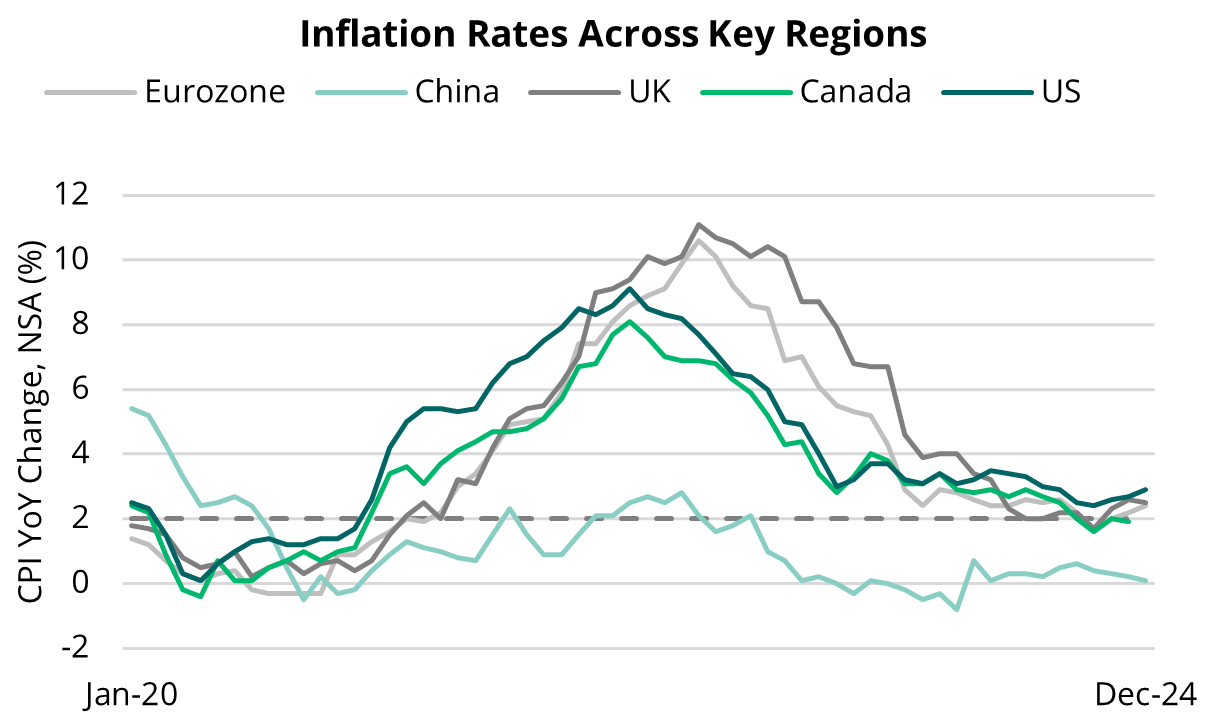

Canada Hits Inflation Target but Struggles with Sluggish Growth

While achieving its inflation target of 2% in 2024, Canada’s economic growth has stagnated. Rising unemployment, contracting GDP per capita, and looming trade tensions with the US highlight vulnerabilities while the country is navigating political uncertainty with the recent resignation of Prime Minister Trudeau. With a potential trade war on the horizon, including proposed 25% tariffs on Canadian goods imported to the US pose additional risks on both sides, which reciprocal impacts including the potential for increased import costs and rising oil prices in the US, given that over half of US crude oil imports originate from Canada.

Inflation Pressures Persist Amid Modest Growth in the UK and Eurozone

Both the Eurozone and the UK remain hindered by inflationary pressures. While the UK reported declines to both headline and core inflation in December 2024, the Eurozone has experienced rising headline inflation and stagnant core figures since September 2024. Further, political instability in Germany and France, two of the Eurozone's largest economies, may further erode consumer confidence. This could potentially exacerbate the region's subdued growth, which stood at 0.9% year-over-year in Q3 2024—50 basis points below the prior decade's (2010-2019) average. Similarly, UK growth has been lackluster, likely influencing the Bank of England’s decision to cut interest rates twice last year. While both regions have witnessed cooling labor market conditions during 2024, the Eurozone currently has an unemployment rate of 6.3%, which is historically low for the region.

China's Economy Faces Uncertain Horizons Amid Deflationary Conditions

Structural challenges, including an aging population, a declining workforce, and a lingering real estate crisis, weigh heavily on China’s economy. Growing concerns about deflation impact not only its domestic economy but also pose a risk to trade relations. In November 2024, US goods exports to China accounted for 7% of total year-to-date exports, underscoring China’s economic significance for the US. While China’s annual GDP is expected to reach target of 5% for 2024, long-term structural concerns weigh on the outlook.

A particular area of persistent concern, the real estate crisis, triggered by developer defaults in 2021, has led to a sharp drop in property values and significantly eroded consumer confidence. This, combined with fears of financial losses from key investments, have dampened spending and exacerbated deflation concerns.

Why the US Stands Apart

As the global landscape is marked by uncertainty and instability, we believe the US offers a unique combination of resilience and adaptability in an evolving macro environment. The ability to maintain growth and stability while navigating meaningful challenges highlights why it remains a preferred destination for global capital. In our view, the US presents a compelling case for safety as global economic conditions continue to diverge, which underpins our optimistic outlook for 2025.