This Week’s Developments in the US Economy

The Evolving Profile of US Rentership

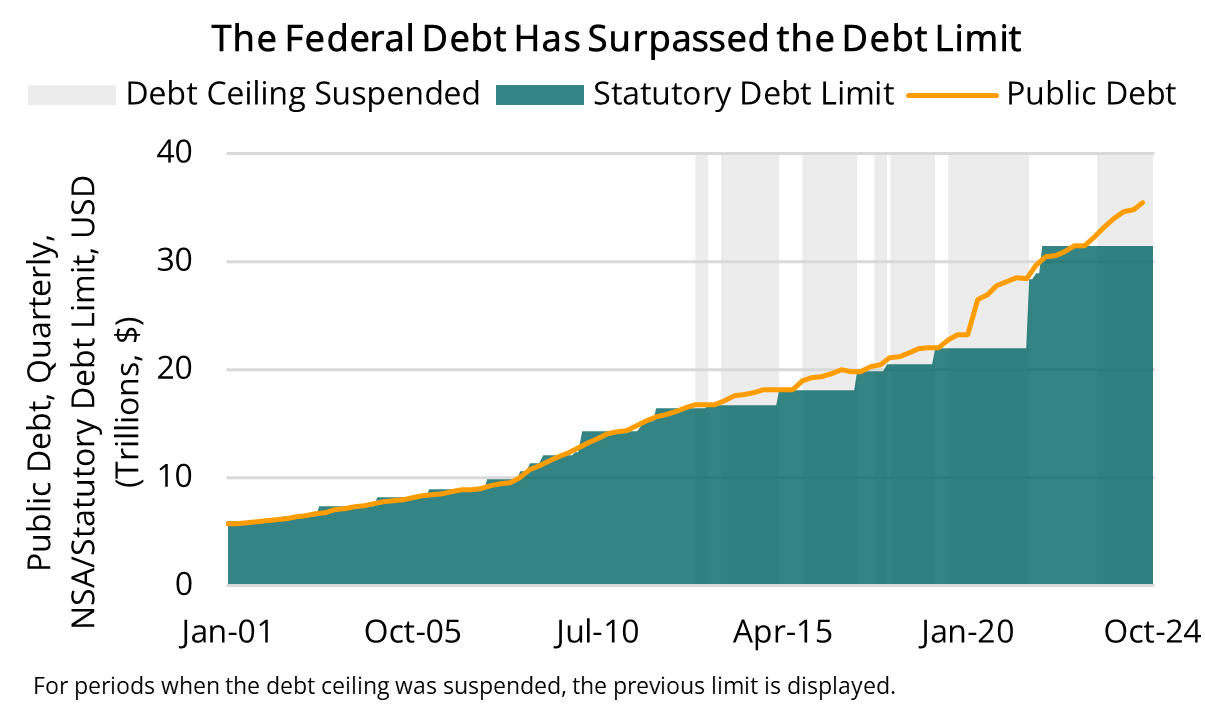

With less than a month until the US debt ceiling is reinstated, the incoming US Congress and Administration will have some decisions to make about extending or raising the ceiling. It is likely that markets will interpret those early actions, which could have meaningful implications for benchmark rates. Even Fed Chair Powell, who has commented on the unsustainable fiscal path throughout the year, reiterated that point this week while emphasizing that the mandate to address the federal debt rests with Congress and the Administration.

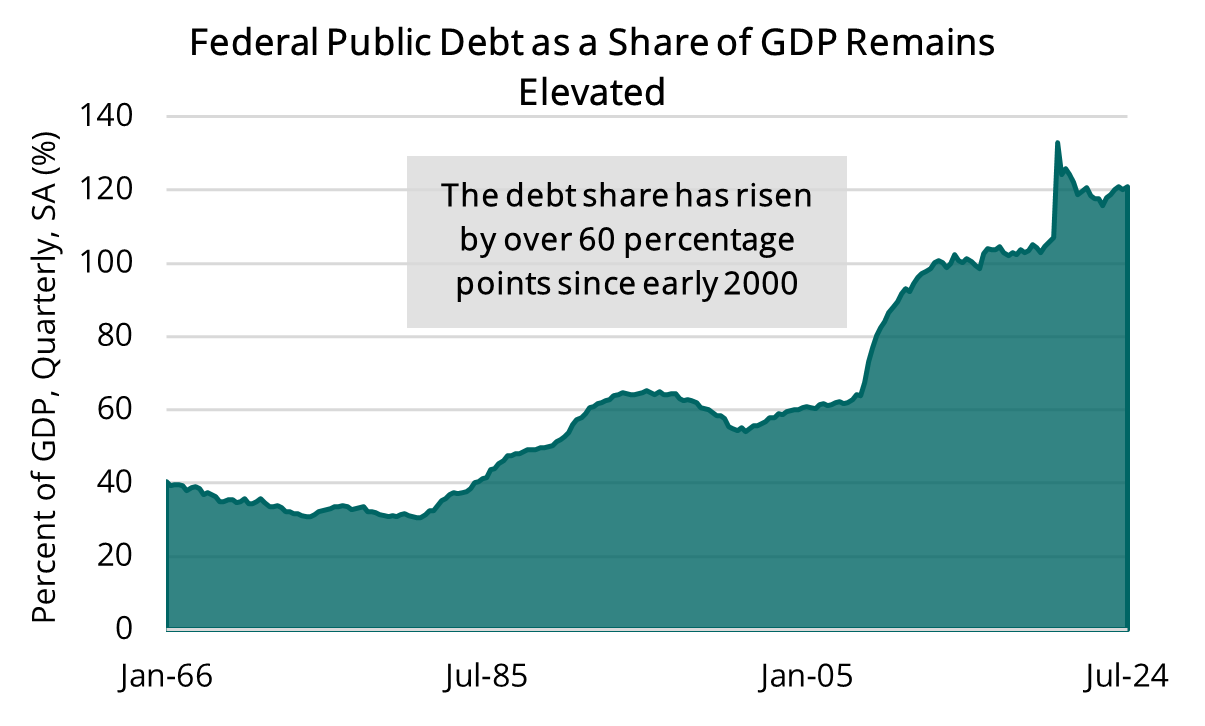

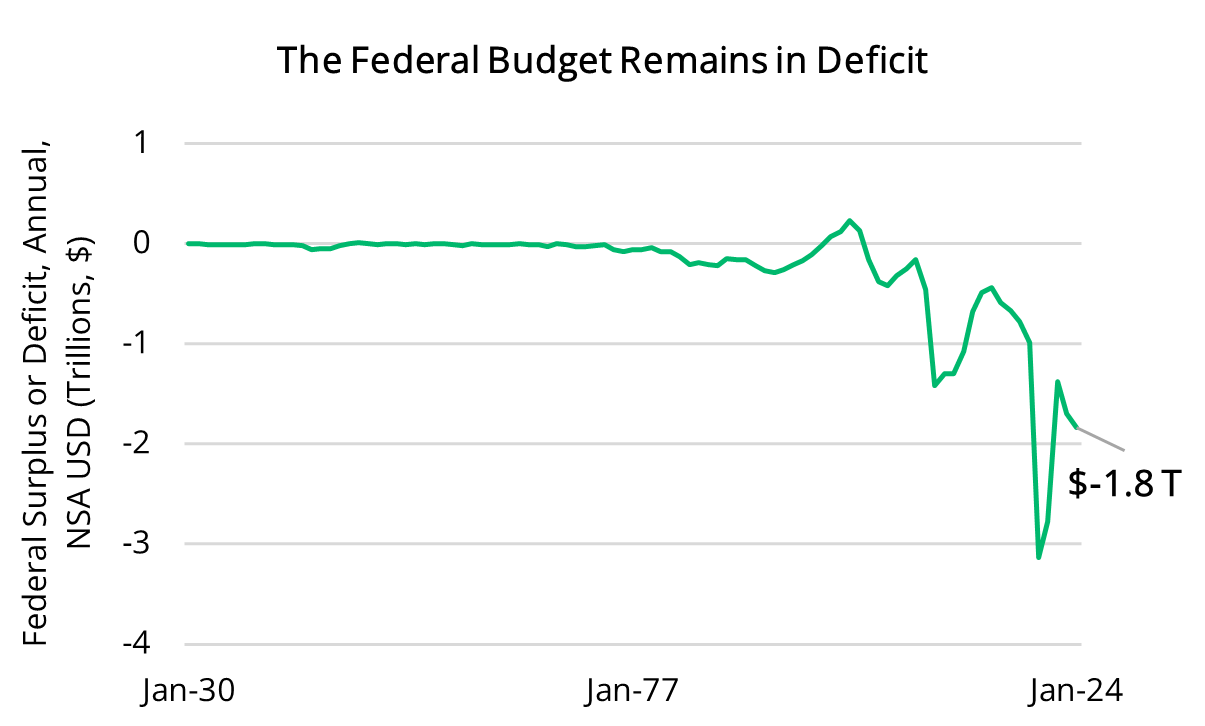

While the path is unsustainable, the existing debt level is serviceable but certainly limiting with respect to federal discretionary spending. The US national debt has reached a historic $36 trillion, nearly doubling over the past decade and requiring increasing debt service costs. Having reached the debt ceiling in January 2023, the limit will be reinstated on January 1, 2025 after being suspended mid-2023 under the bipartisan Fiscal Responsibility Act. As the new year begins, the ability of Congress to navigate the upcoming debt ceiling debate, especially in a new era of higher rates, is likely to be a central issue as lawmakers are sworn in on January 3, 2025.

While we believe meaningful progress by Congress on the debt is unlikely, it is essential to highlight the fiscal challenges ahead, particularly their potential implications for real assets and capital markets. Further, finding a sustainable fiscal path forward could allow lawmakers with greater flexibility to address crucially important need areas such as housing affordability (as one of many examples). But failing to find that sustainable path is likely to affect borrowing costs across markets, affecting investment and financing conditions for businesses and risk assets across sectors.

Finding Terra Firma amid Elevated Borrowing and Fiscal Pressures

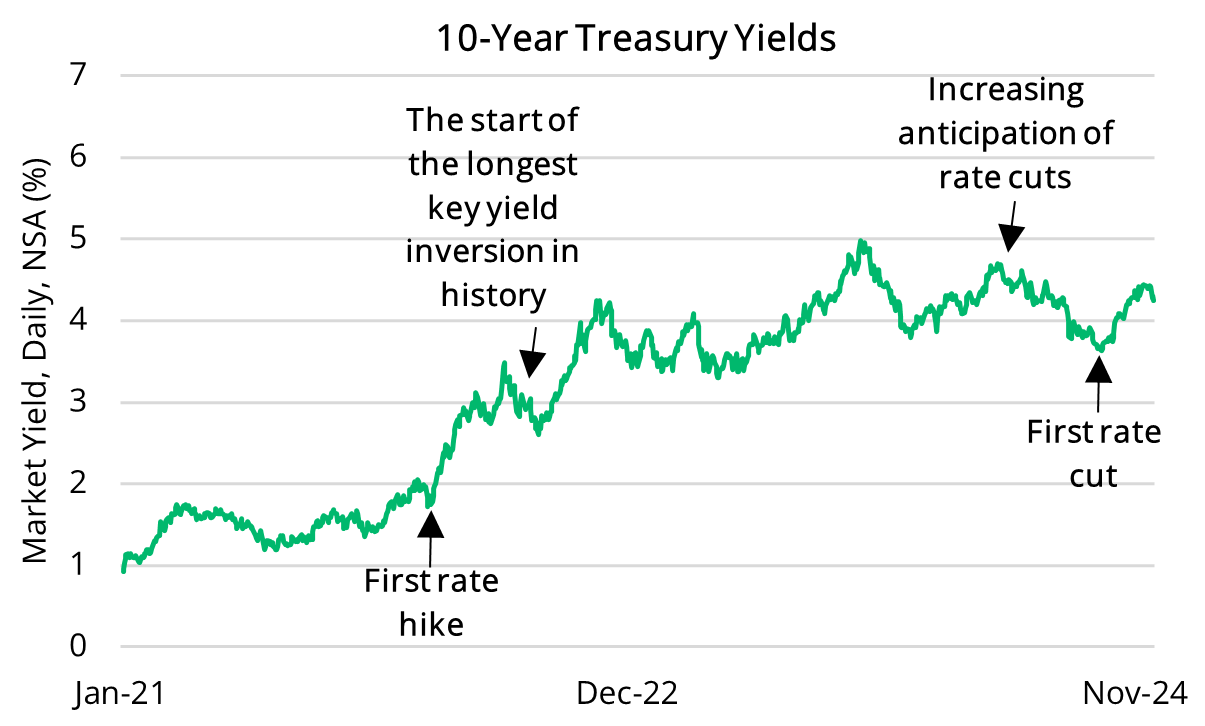

Capital markets have endured a meaningful amount of volatility in the latter half of the year, which reinforces the critical importance of the upcoming debt ceiling debate. A confluence of factors briefly pushed bond yields lower earlier this year, including the anticipation of Fed interest rate cuts, market participants’ confidence that inflation would be effectively controlled, and uncertainties surrounding economic growth. However, following the Fed’s jumbo rate cut in September, 10-year Treasury yields once again surged, climbing 80 basis points to nearly 4.5% in less than two months.

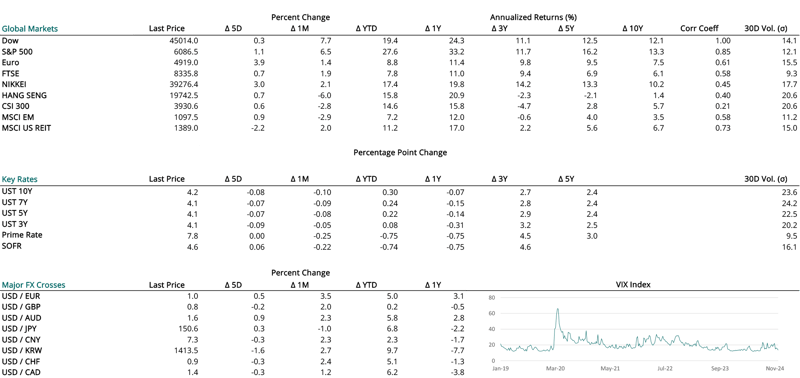

This rise in yields may in part have been fueled by growing concerns over the mounting federal debt ahead of the 2024 US election. Proposed fiscal and legislative priorities—including extending tax cuts, tariffs, military expansion, etc.—could, according to the Committee for a Responsible Federal Budget, add as much as $7.5 trillion to the national deficit over the next decade. Such an increase would worsen an already challenging fiscal environment, with the debt-to-GDP ratio currently standing at 120%.

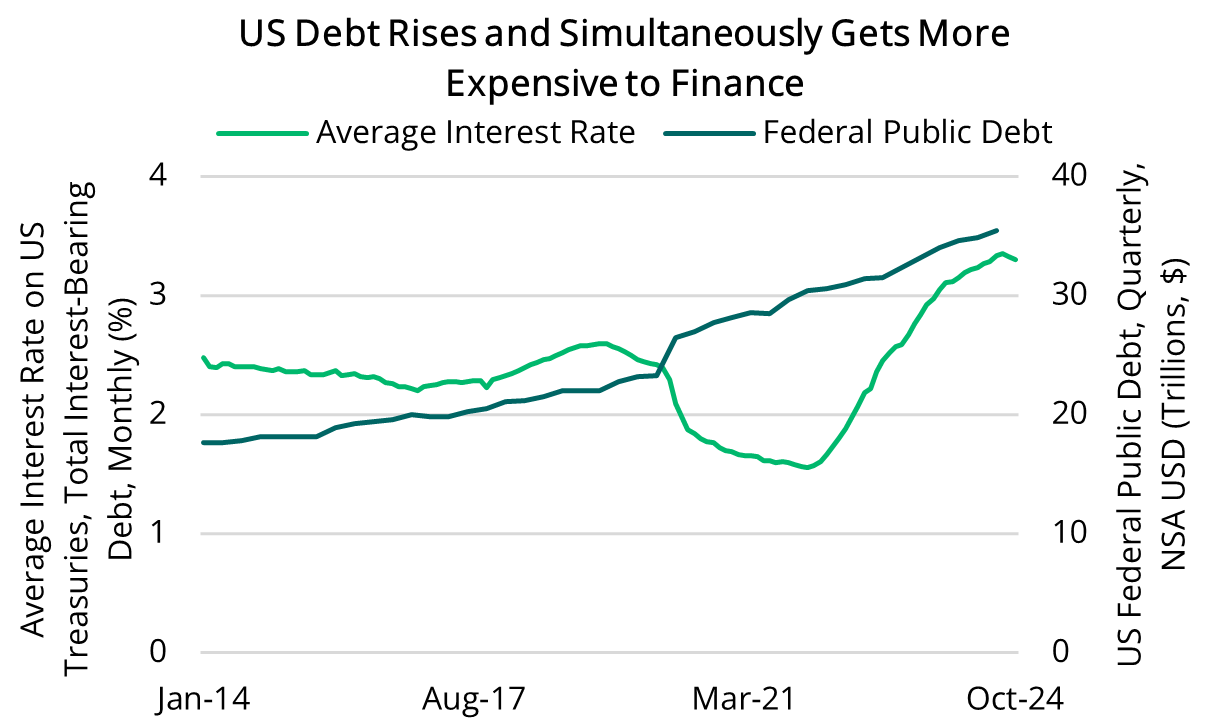

The Rising Cost of the Public Debt

The US Treasury relies on the issuance of securities, such as bonds, to finance its obligations, but the rising interest rate environment has significantly increased the cost of servicing new debt. Over the past three years, the average cost of debt service has more than doubled, reaching 3.30% by late 2024. This increase underscores the mounting strain of record-high debt levels combined with elevated borrowing costs in a tighter monetary policy environment—key considerations for credit rating agencies, which have reinforced the broader message that US fiscal policy needs to find a sustainable path.

What’s Next for Fiscal Policy

While we believe an extension of the debt ceiling is the most likely outcome, with a more definitive resolution pushed to the future, the fiscal challenges at hand carry meaningful implications. Not only will the cost of federal debt demand greater attention, but the broader impact on borrowing costs and capital markets could also shape the financial landscape in the months ahead.