This Week’s Developments in the US Economy

Subtle Shifts in the Outlook

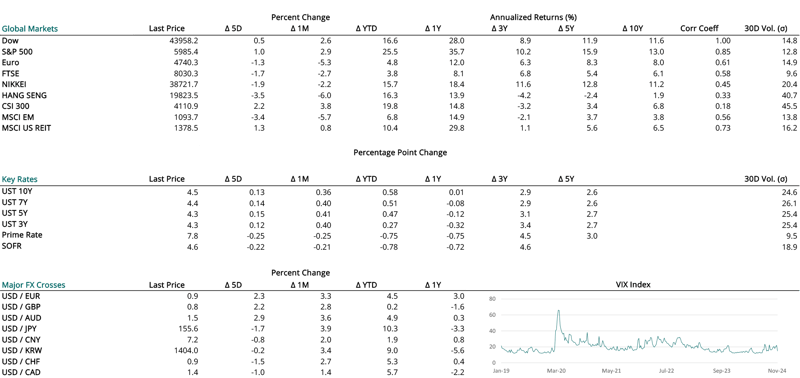

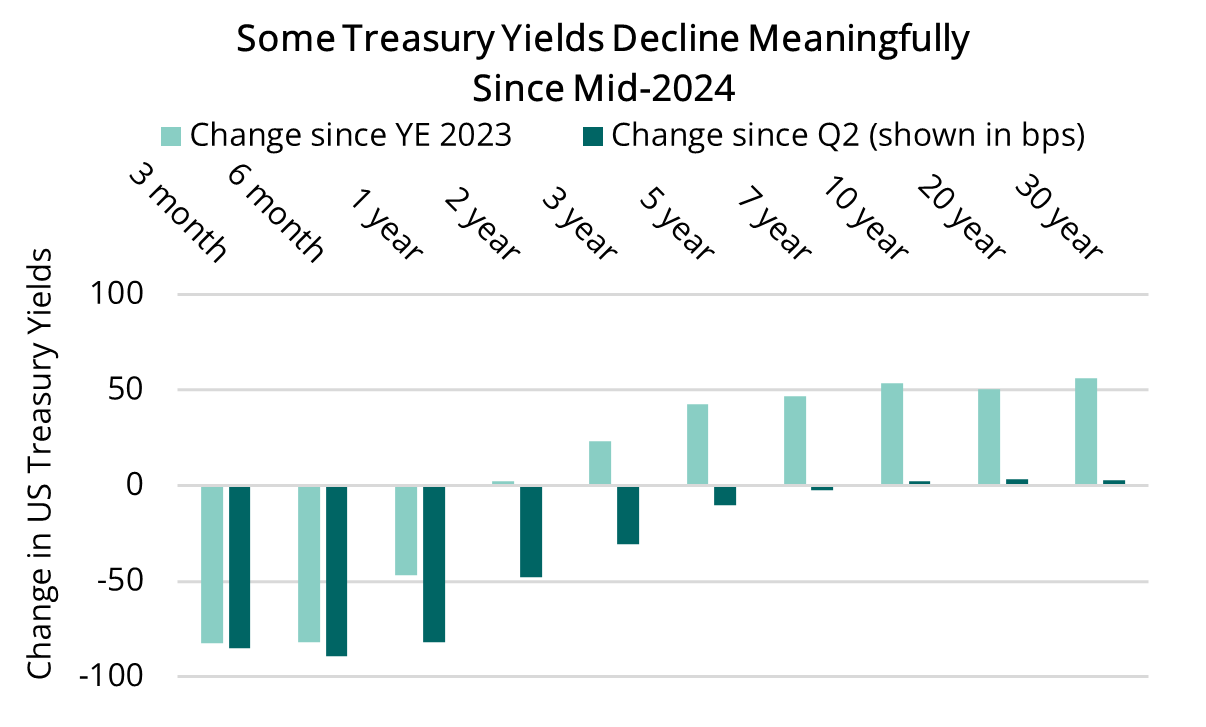

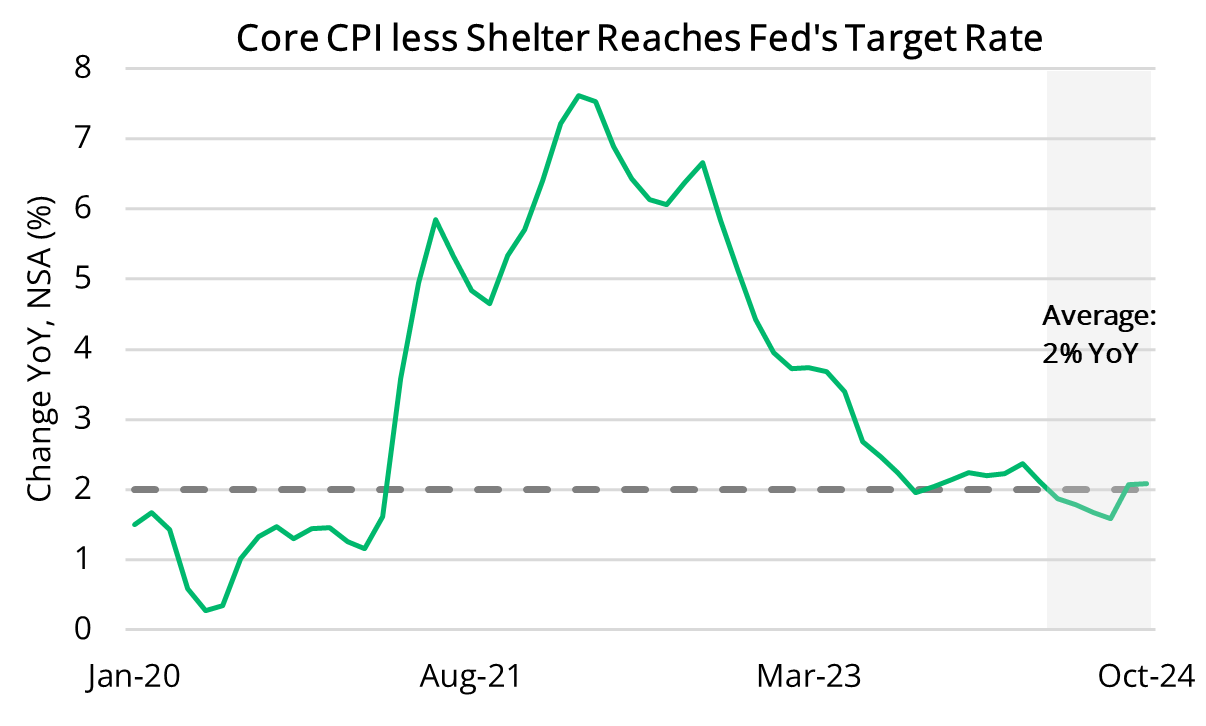

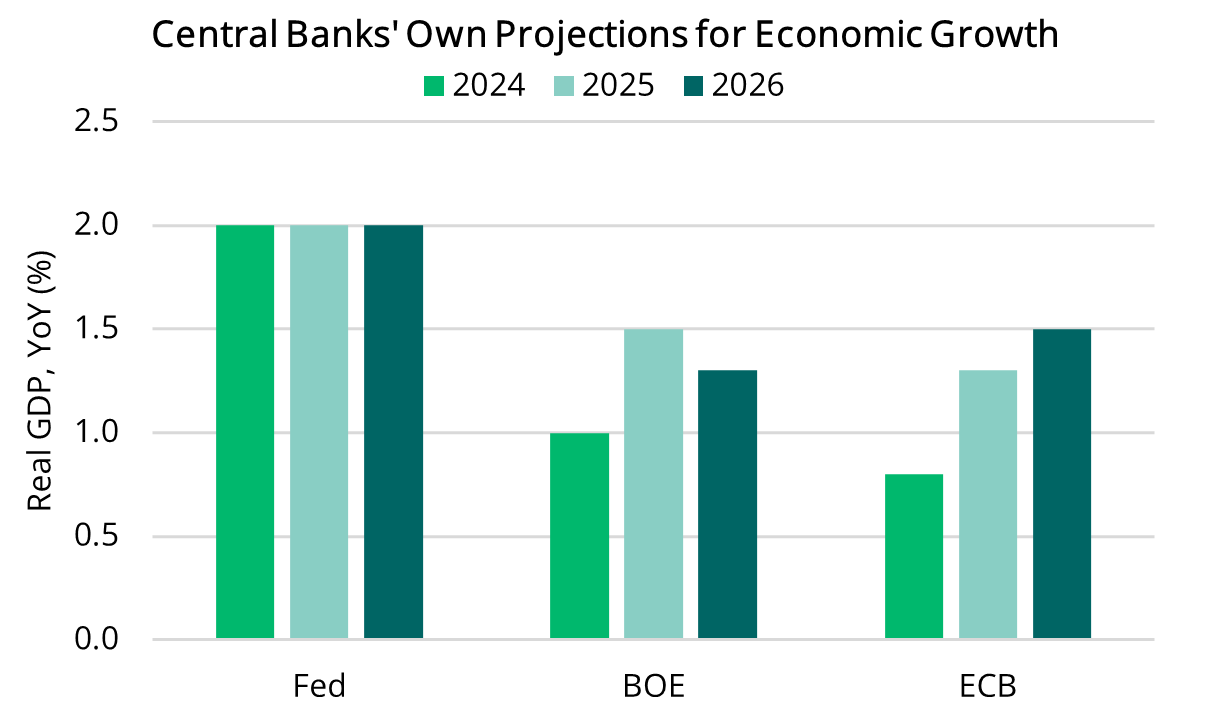

Recent volatility in public markets, particularly US Treasuries, has not only increased short-term uncertainty but has also brought back into focus central banks’ paths to reducing interest rates. With volatility elsewhere, central banks’ policies represent relative stability, though we should not conflate stability with certainty or predictability. However, we can look to the incoming data to assess whether policy loosening is likely to continue and serve as a counter-weight to broader market uncertainty. For example, the latest US CPI highlighted inflation remains close to the Fed’s target levels, and in our view a more accurate reflection of current conditions can be found in core CPI minus shelter, which has been at approximately 2% on average back to September 2023. Notwithstanding positive indications of sustained lower inflation in crucial areas, the potential for slower monetary policy easing remains in part due to robust economic conditions. We see the potential for a high -for-longer interest rate environment that could impact capital market activity across a range of sectors.

Don’t Take Your Eye Off Central Banks

Recent volatility in US Treasuries underscores the critical role of central banks’ monetary policy paths and their ongoing efforts to address inflation. The sustained stability in central bank policies amid Treasury volatility reaffirms their role in shaping market confidence amid broader economic conditions. As inflation continues to moderate, market participants have focused on the scale and timing of potential future rate cuts. While the Fed continues to reinforce a near-term horizon in terms of making monetary policy decisions, Chair Powell and other FOMC members emphasized their data dependent approach and clarified that it is too soon to consider potential policy implications of the incoming Administration when assessing their dual mandate. As the Fed’s narrow focus on price stability and maximum employment remains central to its institutional credibility, we believe there is potential stability ahead with respect to additional interest rate cuts should we see positive and sustained momentum in both areas.

The Fight Against Inflation Is Not Finished

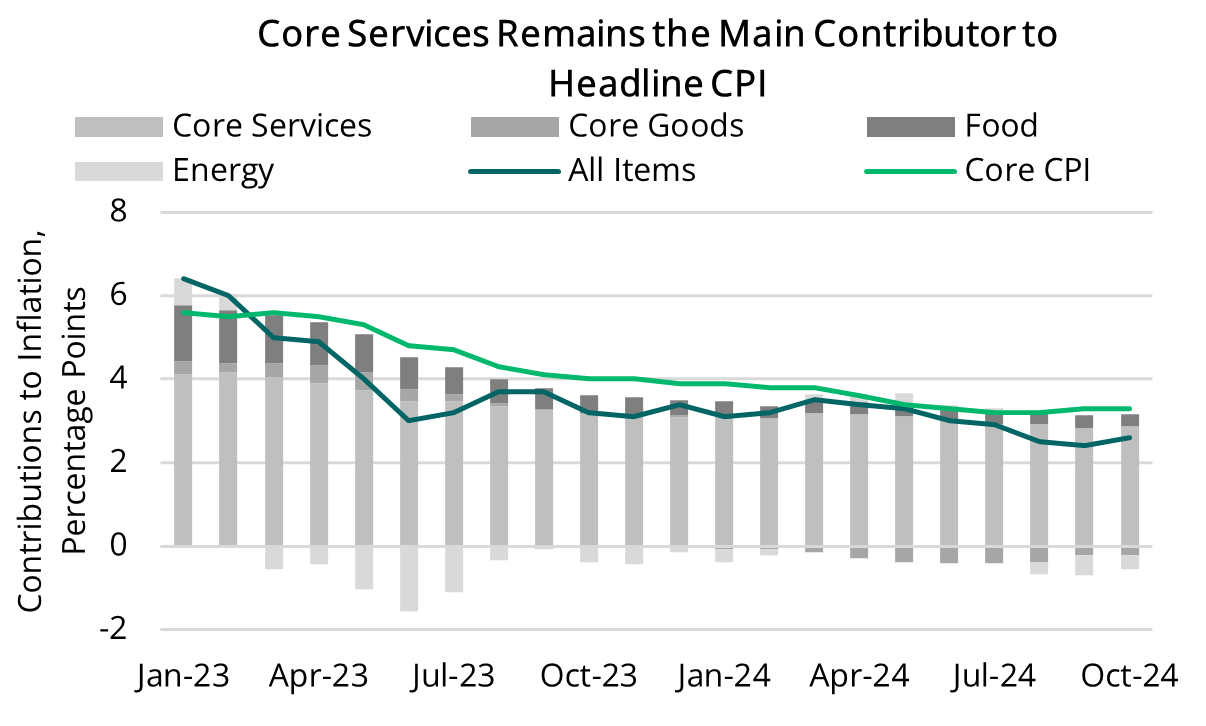

Overall, headline CPI inflation has progressed toward the Fed’s target, dropping meaningfully from its peak of 9.1% in mid-2022. Core CPI has also declined meaningfully from its peak of 6.1% in the second half of 2022, yet some aspects of CPI inflation remaining stubbornly high. This is due to most of the upward pressure on inflation is still derived from service components, and particularly the shelter component, which makes up over a third of the relative importance of overall inflation. Therefore, it is noteworthy that core CPI minus shelter, which reached the target rate in September 2023, has remained at 2% on average for the past year.

The Implications of High-for-Longer US Interest Rates and Risks to the Outlook

Strong economic growth and an evolving outlook suggest that interest rates may remain elevated, which will have implications for many sectors including US CRE. Prior to last week’s FOMC policy announcement market participants were moderately confident about another rate cut during the upcoming December meeting. After key economic data came in as anticipated this week, market expectations remained fairly consistent week-over-week.

Risks to the outlook include persistent inflation and a potential weakening of the labor market. These risks, at least in the short term, appear tilted to uncertainties for the labor market and short-term growth. Persistent price pressures, especially in certain services sectors, could hinder the Fed’s ability to ease monetary policy as expected, which could potentially weigh on both the labor market and growth. If the labor market shows signs of deterioration, we might anticipate interest rates to come in quicker at the expense of farther-reaching implications for economic growth and consumer spending.