This Week’s Developments in the US Economy

The Implications of Robust Consumer Activity: Downshifting to Value While Increasing Online Spending

The week’s release of meeting minutes from the last FOMC policy meeting highlighted caution and concern for upside risks to inflation. Adding to a cautious economic outlook, earnings calls from major retailers, including Home Depot and Target, provided views that signal a downshift in consumer activity to value, a sentiment well-noted in the better-than-expected sales figures from discount retail giants such as Walmart and TJX. Consumer confidence—at least as expressed in total retail sales—outperformed consensus expectations, and in our view this highlights a key element to the resilience of the US economy. While maintaining a cautious outlook ahead, an unknown and seemingly immeasurable event on the horizon is the resumption of federal student loan payments this Fall. This may distort overall consumer behavior, and we expect some decrease in activity given additional financial constraints (despite inflation easing), which we anticipate will contribute to lower headline retail print through the second half of the year.

High Growth in Retail Sales, with a Caveat

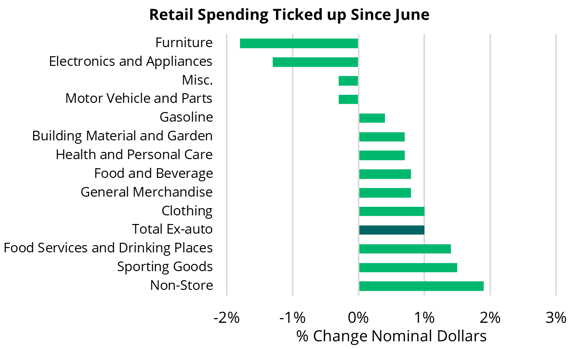

Taking a closer look at the retail data, July’s print highlights a stronger-than-anticipated performance, which suggests positive momentum carrying the economy into the Fall. Retail sales increased by 0.7% compared to June, and 1.0% excluding autos, marking the fourth consecutive month of growth. This growth rate exceeded the revised 0.3% increase seen in the previous month. Importantly, growth in sales also outpaced the 0.2% rise in consumer prices during the same period, suggesting that consumers are spending at a reasonable pace. Non-store retail, or online shopping, continued to increase steadily (see accompanying visual).

Retail Earnings Continue to Decline for Consumer Discretionary

Major retailers like Target, Walmart, and Home Depot, provide a mixed picture of the US consumer, at least with regard to looking backward into the 2nd quarter of 2023. Comparable sales for Home Depot and Target declined by 2% and 5.4% respectively. Notably, sales of high-ticket items (costing $1,000 or more) at Home Depot decreased by 5.5% in the second quarter, which might be due to rising borrowing costs. Consumer sentiment following distress in the banking system, as well as general concerns about softening economic conditions, are likely contributing to cautious interpretations of consumers’ activity last quarter.

On the other hand, we are also observing a continuation of trading down in quality trend in earnings reports from discount and low-cost retailers, such as TJX and Walmart. TJX, that owns T.J. Maxx and Marshalls reported a substantial 6% increase in comparable sales in the second quarter. Walmart also anticipates a 6.4% rise in comparable sales for the same period. This shift can be attributed to consumers being cautious about spending, particularly given the rising costs of essentials.

Consumer Confidence on Big Purchases May be Ticking Up

Despite certain retailers suggesting negative sentiment going forward, the University of Michigan Survey of Consumers sheds light on consumer sentiment, particularly with respect to durable goods. Seen in the accompanying visual, consumers express increasing optimism in terms of better prices as well as more positive sentiment to buying now versus later. There is a generational difference in sentiment, with younger individuals more positive about buying durable goods compared to older adults. Income is also a meaningful factor as well as individuals in the bottom third expressed a sharp decline in positive sentiment. In our view, this highlights the outsized disparity that tightening credit conditions and monetary policy has for lower-income households, which may highlight a crack in the economy’s foundation.

This Week’s Developments in the Global Economy

Taking Stock of Monetary Policy across the Globe

As a growing consensus of market observers seems to indicate that we are at or near the end of a global rate hike cycle, we thought it would be appropriate to take stock of monetary policy across the globe. Looking at eleven of the largest economies in the world, which collectively accounted for 78% of nominal global GDP last year according to the IMF, we found a range of policy positions from restrictive to expansionary. While most of these countries and regions are either easing monetary policy or have paused tightening efforts, many central banks are maintaining in a restrictive position to address inflation. As their collective share of global productivity is meaningful, unintended policy errors could have broad implications, for restrictive and expansionary policies alike.

Restrictive Policies

Among the eleven economies, five are still seeing ongoing tightening of monetary policy. The Bank of Canada paused in March and April but resumed rate hikes in June due to persistent price pressures, and markets anticipate another rate increase in September after a recent uptick in Canadian CPI. Similarly, the Fed paused briefly in June but continued rate hikes in July, despite seeing positive economic indicators between meetings (a potential policy error). In contrast, the European Central Bank and the Bank of England (“BOE”) have consistently raised interest rates, nine times and 14 times, respectively. While there is potential for a pause in the Eurozone, continued wage growth in the UK suggests BOE may tighten further. Additionally, this week the Central Bank of the Russian Federation raised the interest rate by 350 basis point in response to a significant decline in the Ruble, taking the rate to 12%.

Neutral Policies

In four economies, central banks have halted their rate hike campaigns. Aside from a recent adjustment to its yield curve control, Bank of Japan has left monetary policy largely unchanged as the current rate of -0.1% has been in place since 2016. Reserve Bank of India has maintained its repo rate at 6.5% since April but there may be a tightening of policy in the future due to inflation rising from 4.9% to 7.4% in July. Both Australia and South Korea have witnessed a gradual easing of price pressures since the start of the year. As a result, the Reserve Bank of Australia (“RBA”) has paused rate adjustments for two consecutive meetings, and the Bank of Korea’s last rate hike occurred over seven months ago.

Expansionary Policies

Brazil and China have engaged in expansionary policies to try to stimulate the economy. Earlier this month, the Central Bank of Brazil (“BCB”) initiated its easing cycle by implementing an assertive 50 basis point reduction, lowering the Brazilian Selic rate from 13.75% to 13.25%. However, the BCB is far from the average rate of 9.5% between 2010 and 2020 as well as its post-pandemic low of 2.0%, which suggests more accommodative policy may be yet to come. Similarly, the People’s Bank of China unexpectedly lowering its medium-lending facility by 15 basis points this in an effort to stimulate its economy. Given China's deflationary concerns, additional easing measures may be anticipated in the near future.

Overall, the trend of central banks’ decelerating actions and the increased number of pauses, the era of tightening may be coming to an end as the general momentum suggests a transition in monetary stance may be on the horizon.

Market Rates, Catalytic Indicators, and the Week Ahead