This Week’s Developments in the US Economy

Residential Investment Continues to Slide as Fed Hikes Again Amid Strong GDP Print

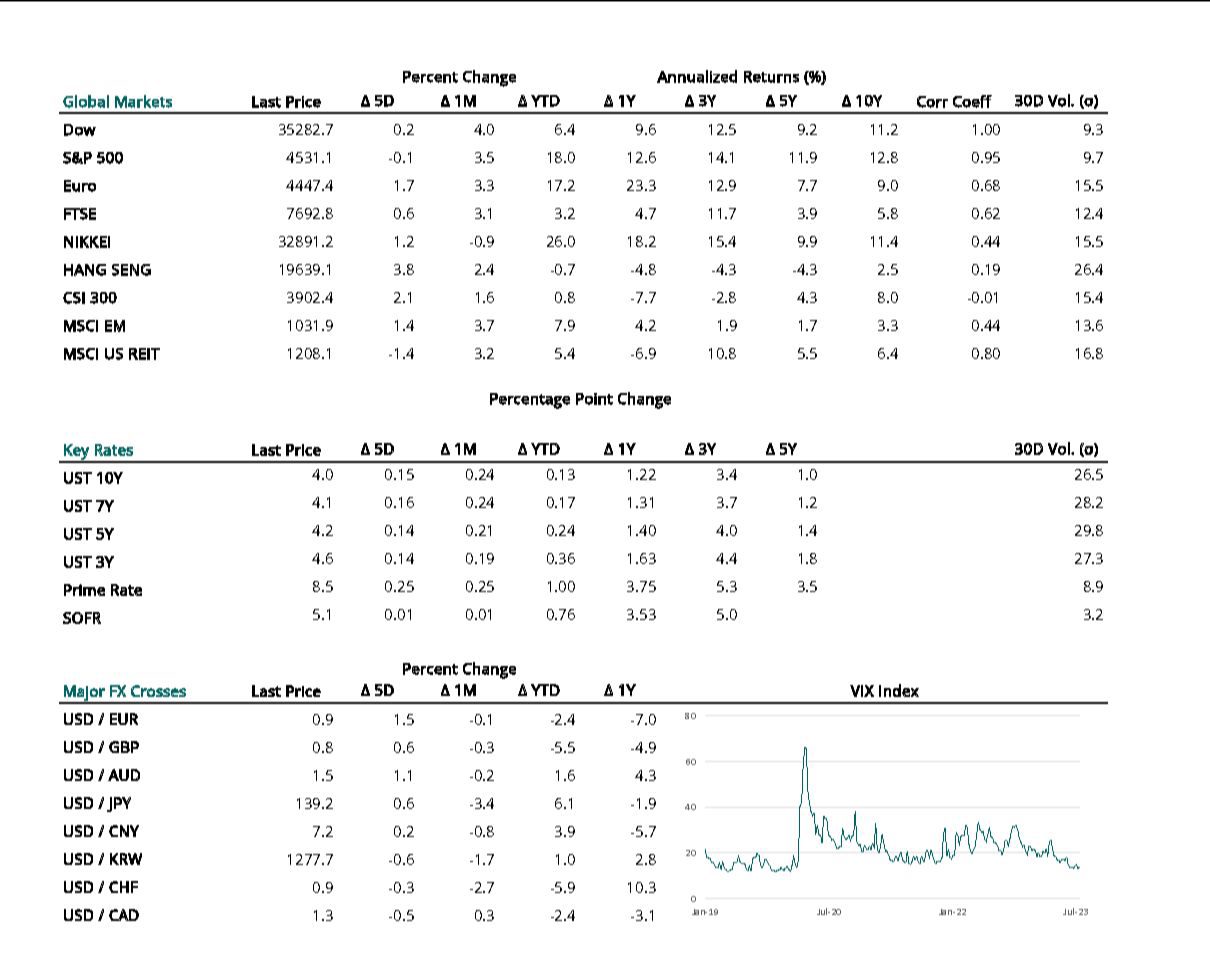

As second quarter GDP growth surprised estimates with a higher-than-expected headline figure, key inflation drivers showed signs of deceleration quarter-over-quarter, further bringing into question the Fed’s decision to continue raising rates this week. Offering the benefits of hindsight, the GDP print provides a lookback at the prior quarter, in which consumer spending pulled back relative to the prior quarter while residential investment continued its downward trend that began in mid-2021. While inflationary pressures are likely to continue to subside as a result, our view is that economic resilience is more likely than not to embolden the FOMC to keep rates higher for longer as downside risks to the economy appear to be lessening. The key takeaway is that the tightening of monetary policy has significantly impacted interest rate-sensitive sectors, resulting in a meaningful deceleration of inflation without severely harming economic growth—at least not at this juncture.

The second-quarter upswing in GDP primarily stemmed from modest consumer spending and a turnaround in private domestic investment, with declining imports and exports largely offsetting each other. Yet, the shifting contributions of these components from the previous quarter have meaningful implications for the economy and the Federal Reserve's future interest rate decisions.

Personal consumption expenditures (“PCE”) exhibited a modest 1.6% increase over the quarter, notably lower than the 4.2% growth seen in Q1. While decelerating growth in goods and services consumption could imply alleviating price pressures, it has not yet been discouraging enough to impact private domestic investment outlays, which we believe bodes well for labor market stability. However, residential investment continues to contract, in line with downward trends in construction starts and permits, pointing to an expectation of decelerating supply growth beginning in the next several quarters.

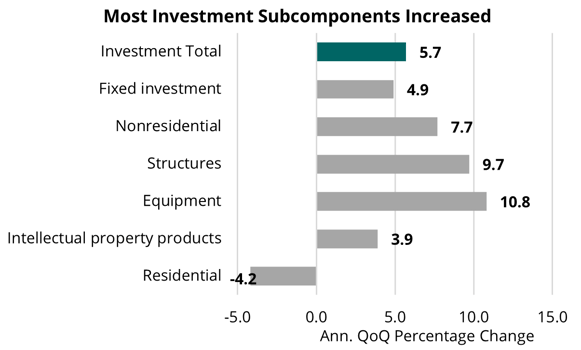

What may increase the braking force on the overall economy is a projected slowdown in global trade, which appears to have taken hold already to some degree. Exports contracted by -10.8% during the quarter, while imports decreased by -7.8%, which is in line with the IMF's projection of a slowdown in global trade. The IMF anticipates world trade growth to be a mere 2.0% in 2023, which is considerably lower than the 5.2% growth seen in 2022. Despite these potential headwinds, however, the IMF has revised its outlook for the United States positively in each of its three projections this year, forecasting 1.8% annual growth for 2023, up from 1.6% in April and 1.4% in January. This upward revision is largely attributable to the continued strength of the labor market, which continues to be key to the resilience of the US economy.

This Week’s Developments in the Global Economy

Forward Indicators Suggest Slow Growth Ahead in the Eurozone

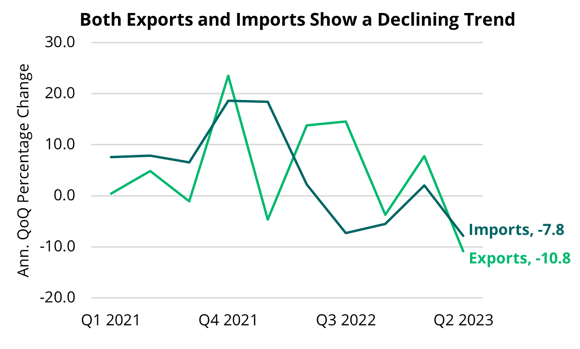

The Eurozone faces challenging economic conditions as declining Purchasing Managers’ Index (“PMI”) figures highlight a protracted slowdown in the region. The emerging trends in both manufacturing and services sectors suggest a long road to recovery ahead. With dampened growth in the Eurozone already a reality, mounting concerns about a deepening economic downturn and the potential implications for global and US growth come to the forefront.

This week, the Eurozone July flash composite PMI fell into contractionary territory, largely driven by the manufacturing sector, but with the service sector weakening as well. Prices charged by manufacturers decreased at the fastest pace since 2009 when the global financial crisis caused a substantial downturn in demand, and in addition service sector price inflation saw its lowest reading in almost two years. Given the PMI serves as a leading indicator, the economic growth outlook for the Eurozone appears discouraging, and, despite the Euro Area Q1 GDP revised up to 0% from negative territory, growth projections remain sluggish.

Faltering Eurozone demand has potential repercussions for US growth. The spillover effects might impact the flow of financial activity between the regions and low demand for US goods and services would decrease exports, dragging down GDP and potentially weakening the dollar. The external risks could introduce further domestic downsides, including reduced consumer confidence resulting in limited business and household spending. Knock-on effects have yet to materialize, but with forward indicators signaling a protracted economic slowdown in the Eurozone, the extent of its negative impacts globally and in the US remain to be seen.

Market Rates, Catalytic Indicators, and the Week Ahead