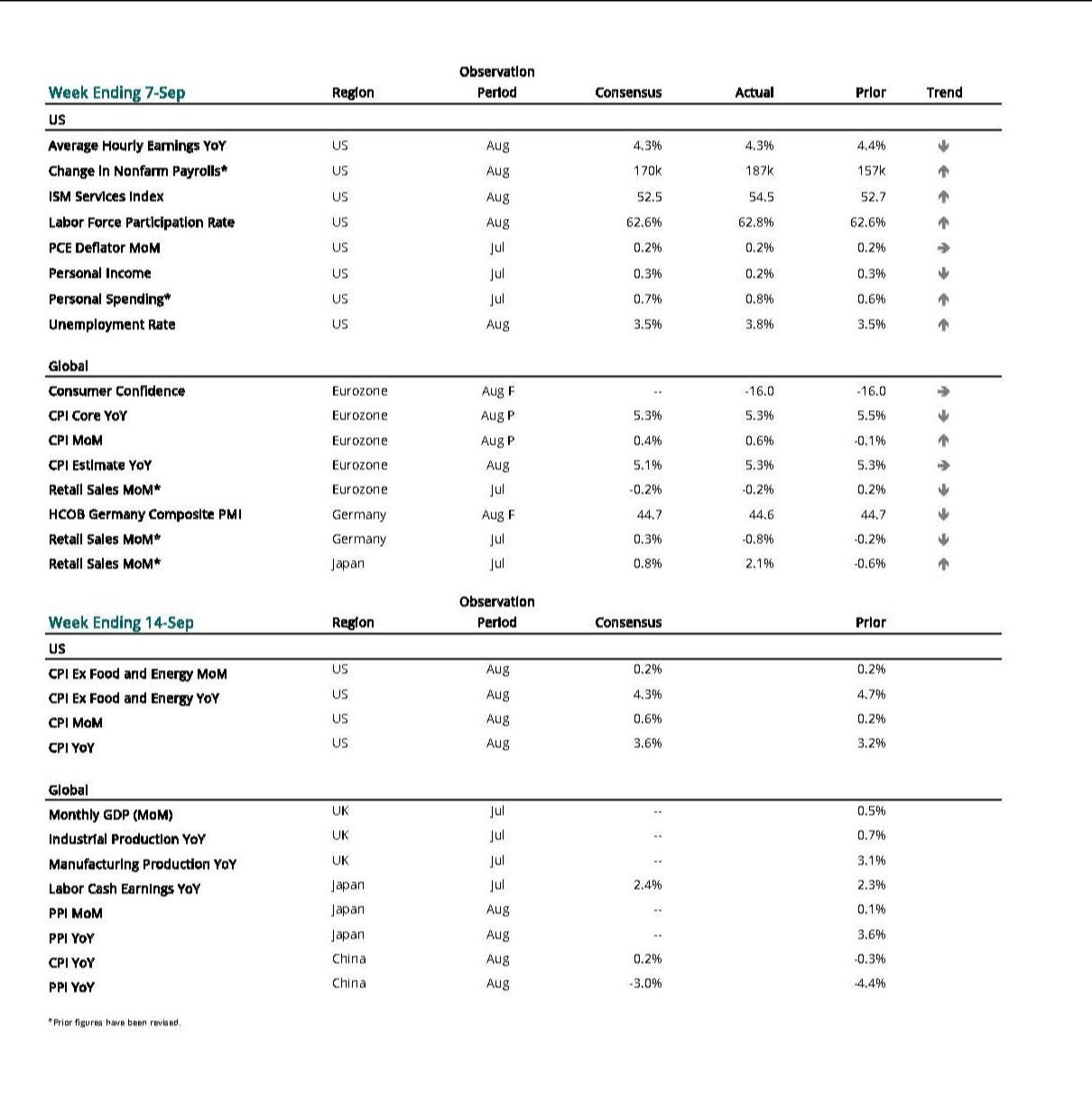

This Week’s Developments in the US Economy

Separating Real from Perceived: The Resilience of Labor Markets and Consumer Spending

Entering the last month of the third quarter, economic momentum continues in what appears to be mutually reinforcing labor market dynamics and consumer activity. Despite multiple consecutive months of robust data in both areas, consumers seem unconvinced as sentiment surveys paint an altogether different picture (however inaccurate the picture might be).

Overall, conditions appear to be normalizing relative to pre-2020 levels, which was a period of sustained economic stability propelling many sectors, including real estate, with strong tailwinds. The labor force participation rate continues to improve, bolstered by the highest participation by prime age adults (25-54 years old) in five years. Personal expenditures not only accelerated during the month of July, but both are also normalizing with respect to the long-term trend of distribution between goods and services. US economic resilience has been tested, between labor market shocks of strikes and bankruptcies, and the resumption of student loan payments are the next challenge on the horizon. Signs continue to point to strength and stability in the US versus uncertainty abroad.

Labor Market Indicators Softening, But There Is a Lot of Nuance

The labor market saw an increase of 187,000 net new jobs in August, which is another month’s initial reading of job growth above the previous cycle’s long-term average. The emphasis on “net” is because this elevated print occurred despite the BLS noting a decline of 37,000 jobs in truck transportation “largely reflecting a business closure” (Yellow’s bankruptcy) and a decline of 17,000 jobs in motion picture and sound recording industries “reflecting strike activity” (Hollywood’s actors strike).

A much-needed increase in labor market slack appears to be occurring not only due to isolated shocks, but also to increases in the labor force participation rate. As 736,000 individuals joined the labor force since July—which was much higher than job openings for the same month—the U-3 unemployment rate increased by 30 basis points to 3.8% while wage growth moderated, increasing by only 0.2% from the prior month.

Consumer Confidence and Normalization of Spending Trends

In July, the consumer-influenced University of Michigan's Consumer Sentiment Index saw an uptick, only to retreat slightly in August. Meanwhile, the labor-influenced Conference Board indices are softening. Interestingly, post-pandemic months have highlighted a disconnect: consumer spending remains robust, outpacing tepid confidence metrics. Similarly, a strong labor market suggests a disconnect with the Conference Board’s surveys as well. For example, the data on July's personal consumption expenditures surged by $144.6 billion—with services taking the lion's share at $102.8 billion. This marked shift back to services, signaling a return to pre-pandemic trends (at least from a trajectory perspective), correcting a tilt towards goods consumption.

Goods spending holds 33% of the overall share, up two percentage points from the pre-pandemic five-year average. While services spending remains slightly below its pre-pandemic average, the normalization of spending patterns coincides with the portions of the labor market seeing a meaningful return of workers, which we believe highlights the potential for continued economic resilience in the coming quarters.

This Week’s Developments in the Global Economy

The Potential for Additional Separation of Global Monetary Policy

In our last Weekly Note, we examined the range of various global monetary policy positions. Following this year’s annual economic symposium in Jackson Hole, it is increasingly evident that major global economic regions continue to face distinctly separate economic challenges, which are factoring into diverging monetary policy responses. The risks appear to tilt more unfavorably to economic regions where monetary policy is not having the desired effect while also having ancillary negative effects.

The Eurozone and China serve as a prime example of this divergence: two different economic trajectories with accordingly different approaches to monetary policy. The European Central Bank (“ECB”) remains attentive to the persistent inflation exceeding target levels. Without clear signs of moderating prices, the ECB maintains its position of considering further tightening in the upcoming September meeting. In contrast, China faces deflationary concerns and is providing little forward guidance as it responds to an already slowing demand. China has embarked on a series of policy easing measures with the primary focus of stimulating its economy. While it is unlikely to affect global markets or trade, the broad-based nature of the stimulus suggests a large, broad slowdown that may weigh on sentiment (which, if like the US, may not correlate directly to domestic or foreign activity). The slump in China’s real estate sector serves as a poignant reflection of this deceleration and highlights the comparative resilience of select segments within the US real estate market, even in the face of the Federal Reserve’s tightening measures.

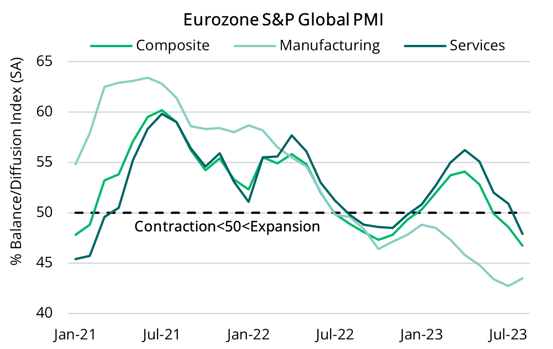

Eurozone Faces Difficult Monetary Policy Decision

Within the Eurozone the ECB appears to be open to the possibility of a policy pause, but the prospect of another rate hike is our base case with the primary commitment to an objective of bringing inflation down to 2%. Similarly, we believe the Federal Reserve has a higher likelihood of raising rates as opposed to the neutral position markets are taking currently.

In August, Eurozone core inflation experienced a slight dip, moving from 5.5% to 5.3%, but headline inflation remained at 5.3%. Additionally, in the same month the composite Purchasing Managers' Index (“PMI”), a crucial leading indicator for economic growth, dropped to 46.7 (below expansion, see accompanying visual), partially driven by a decline in the service sector. This balancing act of combatting inflation while simultaneously nurturing economic growth has further complicated the ECB's forthcoming monetary policy decision in September.

China Attempts Reviving its Economy

In China, the current deflationary figure of -0.3% price growth highlights a sluggish economy. July witnessed the lowest number of new loan originations since 2009, and July's year-on-year imports plummeted to -12.4%, starkly highlighting the decelerating demand. China has responded with an array of easing measures. The country has lowered its medium-lending facility from 2.65% to 2.5% for $55.25 billion worth of loans and the government recently announced a 200-basis point reduction of the foreign exchange reserve requirement ratio, lowering it from 6% to 4%. Caution lights are vast, especially in the real estate sector where residential developers responsible for 40% of home sales in China have defaulted. To mitigate the weak demand in the real estate market, the government has cut down payments and encouraged banks to decrease the rates of existing mortgages. It is crucial to note, however, that the challenges faced by one country's real estate market, particularly China, should not be conflated as a like-for-like indicator abroad.

Market Rates, Catalytic Indicators, and the Week Ahead