This Week’s Developments in the US Economy

Port Disruptions Highlight the Crucial Importance of Logistics Infrastructure

The crucial importance of US logistics infrastructure came into sharp focus recently in light of the potential for a lengthy strike by East Coast port workers. Also in sharper focus: the potential resurgence of inflation due to endogenous shocks, which appear to have been avoided in this case. In our view, this event highlights the need for infrastructure to support an efficient and smooth-flowing supply chain.

The US economy’s reliance on a fully functioning supply chain is paramount. According to the U.S. Chamber of Commerce, East Coast ports handle over 68% of containerized exports and 56% of imports, with daily trade exceeding $2.1 billion. Over the past year, many ports across the US have seen an increase in traffic and volume, underscoring the severity and potential impact of the strike (see accompanying visual). For example, the port of New York and New Jersey, one of 36 ports impacted by the strike, has experienced a cumulative 18% increase in TEU (“twenty-foot equivalent unit”) volume compared to the 2014-2019 average. Disruption across these ports could have had widespread effects, potentially rippling through supply chains and exerting upward pressure on prices. And with rising risks associated with transoceanic freight and supply chain disruptions, coupled with shifting trends in global trade, many firms have begun to adopt nearshoring strategies over the past few years, further driving demand for the logistics sector and reinforcing the need for robust, adaptable systems to manage the evolving patterns of global and domestic trade.

The Dock Strike Resolved (Tentatively), but Risks Remain

Goods prices in both Personal Consumption Expenditures (“PCE”) and Consumer Price Index (“CPI”) have been in deflationary territory since mid-2023 and early 2024, respectively, marking meaningful progress in curbing inflation. However, the recent dock strike highlights that inflation risks remain elevated. As tens of thousands of International Longshoremen's Association (“ILA”) members ended their three-day strike and returned to work at East and Gulf Coast ports, the disruption still raises concerns about inflationary pressures as it has temporarily strained coastal port operations, providing a view into how extended shocks could have ripple effects for the economy.

Sufficient infrastructure is crucial. Ports have a finite amount of space to store containers, and once that capacity is reached, operations can quickly become overwhelmed. Considering that ports, according to the U.S. Chamber of Commerce, estimate that each day of a strike requires roughly 5 to 7 days to fully recover and, given the arguably short-lived nature of the strike, we are anticipating that the backlog will be resolved in the coming weeks and not meaningfully impact inflation.

What’s Changing the Nature of Logistics Demand: Shifting Global Trade Patterns

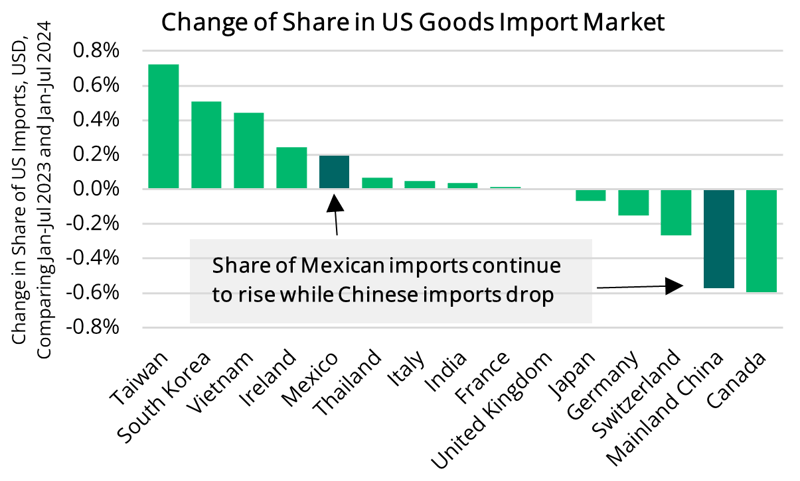

Amid geopolitical pressures and evolving globalization trends, shifting trade patterns are emerging among the five largest countries supplying US imports (see accompanying visual). In 2023, Mexico’s of imports to the US overtook China, which was once the most dominant player in the US import market. By Q2 2024, China's share of US imports had fallen to 13.0%, nearly half of its peak average of 20.9% between 2014 and 2018. In the first half of 2024, China’s share continued to decline, while countries like Taiwan, South Korea, Vietnam, Ireland, and Mexico have seen their shares rise. Mexico now holds the largest share of the US import market, close to 16%, supplying products such as motor vehicles, motor vehicle parts, and computer equipment. The increase in imports from Mexico has also widened the US trade deficit with the country, further contributing to the overall US trade deficit, which is primarily driven by the trade of goods.

Nearshoring and Reshoring: An Increasing Reality for Many US Companies

The shift in US trade dynamics in recent years, along with increasing number of firms highlighting the need for nearshoring, suggests nearshoring as a reality for many companies. Factors such as tariffs on certain Chinese products, along with risks tied to sea freight and supply chain disruptions—including the recent dock strike and the pandemic—are motivating companies to move production closer to home. Mexico has emerged as a key destination, as indicated by US imports from Mexico rising by 52% between 2017 and 2023, and 54% of foreign direct investment in the first half of 2024 flowing into the manufacturing sector. The increase in imports from Mexico also illustrates the growth in demand for land freight logistics. As companies choose to relocate production to Mexico, the need for efficient cross-border transportation, warehousing, and distribution networks has become crucial.

We believe the continued strength of US domestic demand, affirmed by robust wage and spending data, indicates that this increased demand for logistics infrastructure is likely to be sustained over the long term, creating opportunities for growth in freight and logistics services.