This Week’s Developments in the US Economy

Market Turbulence

Following last week’s FOMC meeting, market participants appeared to coalesce around two points: a September rate cut looked increasingly likely, and the Fed was becoming more acutely focused on and concerned about the health of the labor market. These concerns manifested into market turbulence across the globe as last week’s jobs report underwhelmed by a meaningful margin. Despite many labor market metrics remaining strong and above historical averages, recent weaker-than-expected unemployment and job growth figures raised recession fears and recent market reactions reflect heightened caution.

The economic outlook has not changed much in our view, and we expect moderate growth ahead. While flashing warning lights such as the Sahm Rule, rising consumer debt, and escalating geopolitical tensions highlight risks to the economic outlook, we view the balance of conditions as supportive of continued domestic growth. Amid the highest interest rates in over two decades, the economy is progressing steadily and is, in our opinion, likely to avoid a recession and with the potential to achieve a soft landing.

Interpreting Signs of a Moderating Labor Market

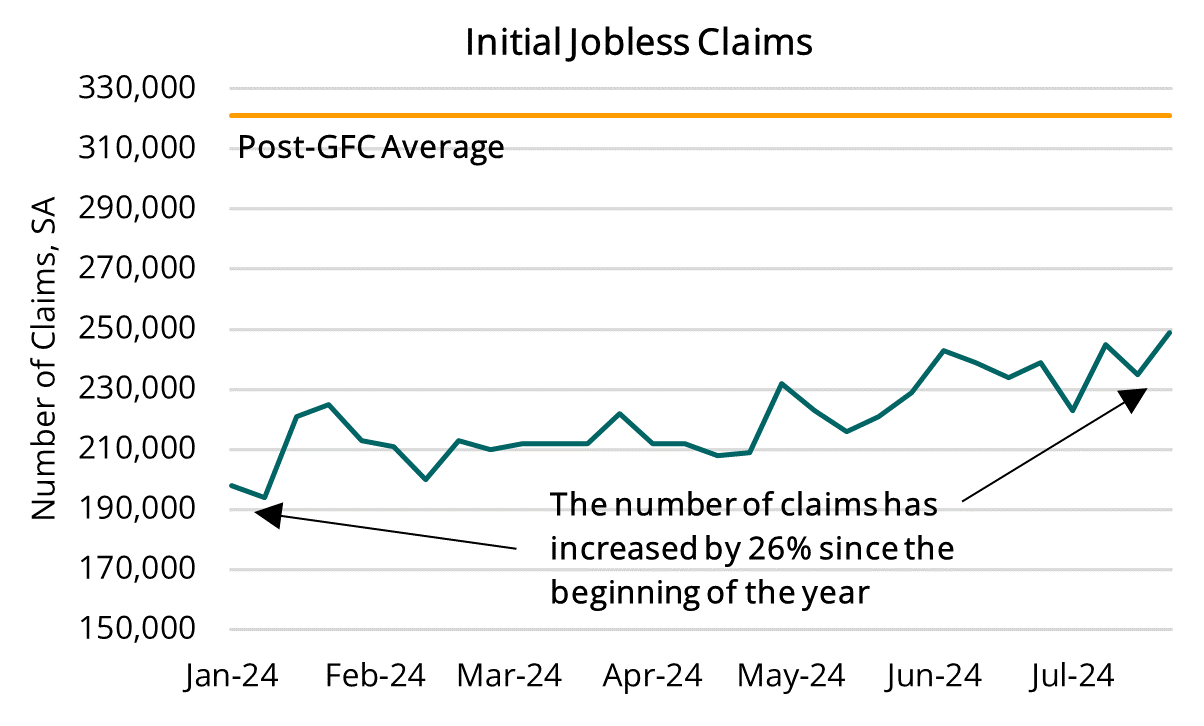

Recent data indicates further cooling in certain aspects of the labor market, yet many labor market indicators are robust relative to historical context. In July, average hourly earnings fell to 3.6% year-over-year, the lowest annual growth rate in over three years, but still above the post-GFC average of 2.4%. Initial jobless claims have risen by 26% year-to-date and 4% year-over-year yet remain significantly lower than levels seen during the last business cycle (post-GFC) and previous recessions. Non-farm payroll month-over-month growth fell to 114,000, below the post-GFC average of 166,000 but slightly above the historical average when viewed as a three-month moving average.

Markets appear to be responding to a confluence of indicators, including those that have has historical correlation with recessions. In July, the unemployment rate increased from 4.1% to 4.3%, which triggered the Sahm Rule where the three-month moving average of unemployment exceeds the 12-month low by at least half a percentage point. While we may not be in a recession from a domestic growth perspective, current unemployment trends are starting to mirror those seen in past recessionary periods. However, job growth (albeit moderate this past month) has not yet decelerated to the degree where we see cause for concern—more so a cause for observation. (See accompanying chart)

What should not be overlooked is the deceptively tight labor market. The unemployment rate is still below the natural unemployment rate of 4.4% estimated by the Congressional Budget Office for Q2 2024 and significantly below the post-GFC average of 6.4%. We see tightness in a growing labor force, which reached a participation rate of 62.7% in July, and the participation rate for prime-aged workers (25-54) climbed to 84%, the highest in over 20 years. From the perspective of the availability of labor—or the lack thereof—we are mindful of the potential risks that labor market tightness presents to the outlook.

Consumer Spending Sustained by Increasing Debt as Savings Depleted

For much of the past several years, consumer spending appeared to be fueled by excess savings following a period of pent-up demand. Today, it appears that demand remains robust, and consumers are increasingly reliant on debt as savings are depleted.

This is a potential economic headwind, but like many recent indicators does not necessarily imply a slowdown. The latest NY Fed Household Debt and Credit report reveals that total household debt rose to a record $17.8 trillion in Q2 2024, with credit card balances increasing over ten percent year-over-year. However, like labor market indicators, historical context matters: overall loan delinquency rate remained stable at 3.2%, and household debt service payment as a percentage of disposable personal income was 9.8% in Q1, slightly below the previous cycle's historical average of 10.3%.

What It Means for US Economic Growth

Despite potential headwinds from a moderating labor market and rising consumer debt levels, US economic growth has remained robust. The advanced Q2 GDP estimate exceeded expectations at 2.8%, far surpassing consensus at 2.0%. Consumer spending increased its contribution from one percentage point in Q1 to nearly 1.6 percentage points in Q2. Driving this boost was higher spending on goods, including vehicles and durable household equipment, as well as in services categories like housing, utilities, and recreational activities. Although the trade deficit continued to weigh on GDP, private inventories rebounded after two quarters of negative contributions, effectively offsetting the drag from net exports. Looking ahead, the Atlanta Fed is forecasting 2.9% annualized quarter-over-quarter growth in Q3, further bolstering our view that the US economy will slow but likely to avoid a recession.

.png?width=1204&height=726&name=2024%2008%2008%20-%20Labor%20Force%20Participation%20Rate%20(25-54).png)