This Week’s Developments in the US Economy

Behind the Curve?

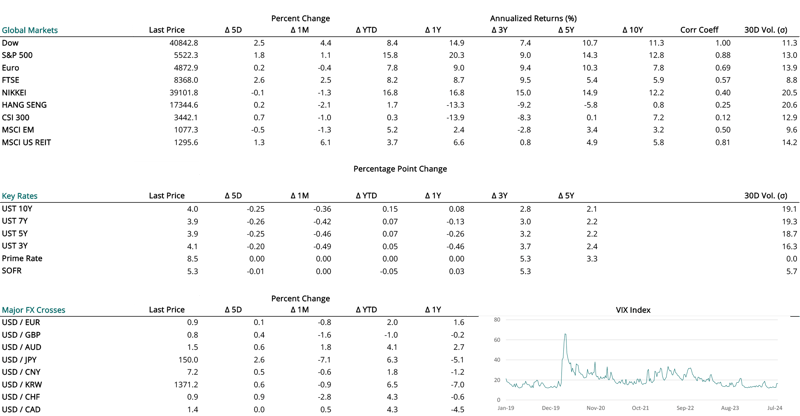

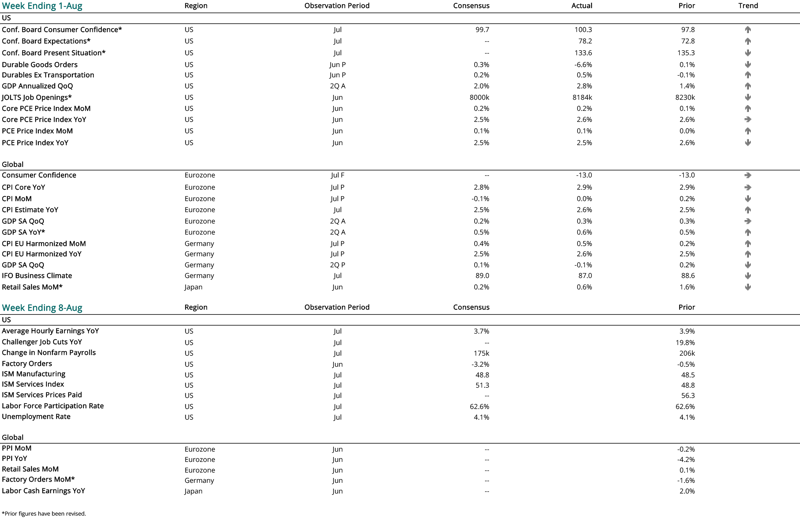

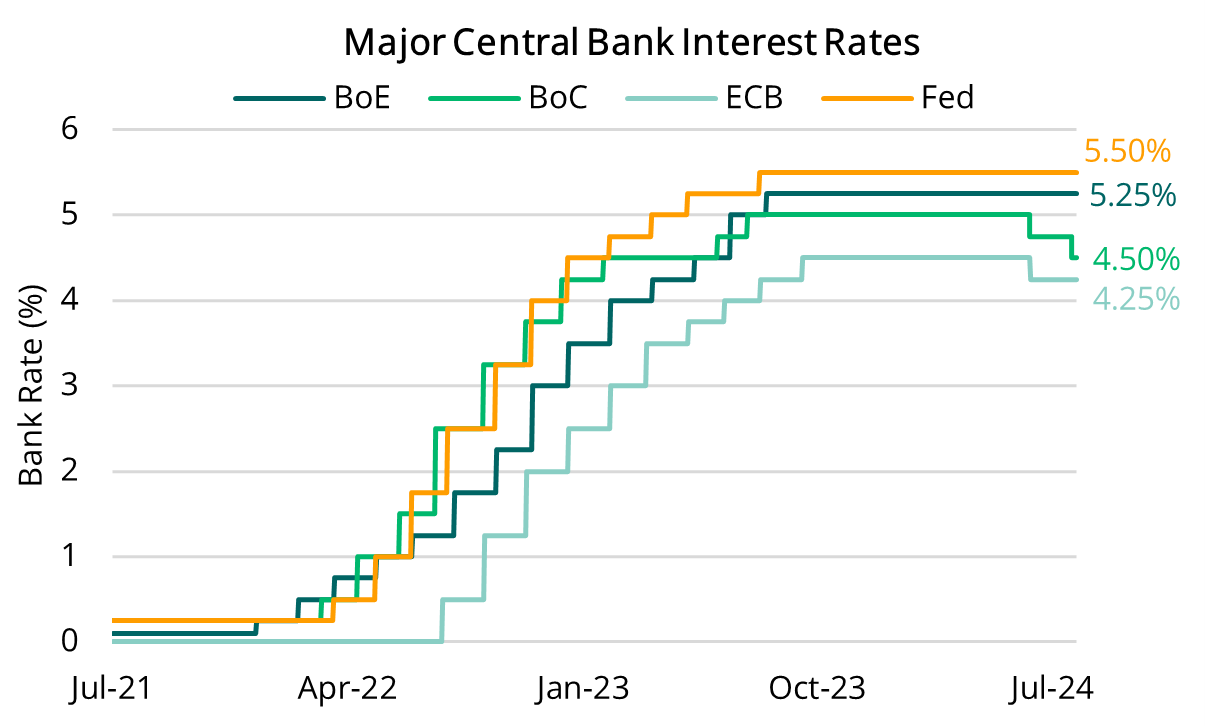

Following nearly two years of tighter monetary policy, many global peers of the US have begun implementing rate cuts. Although unique market conditions in each country make it challenging to compare the timing of monetary policy decisions across regions, expectations for a September interest rate cut held firm following the FOMC policy announcement this week. However, market observers noted that softening economic and labor market data—as well as the lagged and lasting effects on businesses throughout the US—with several suggesting at the FOMC announcement that the Fed was behind the curve and risking a policy error.

While the Fed decided to hold the Fed Funds rate steady at 5.25 to 5.5% during this week’s monetary policy meeting, we note how anticipated rate cuts this year could affect the Commercial Real Estate (“CRE”) environment, which has come under scrutiny during this period of elevated interest rates. The likely scenario is a slow easing of monetary policy, which will likely solidify perceptions of current value, reset to some degree values in areas experiencing continued tailwinds, and a broad resumption of capital markets activity. Although the recovery in property values and transaction volume is expected to be gradual, the market outlook remains cautiously optimistic for accelerating activity through the latter half of 2024.

Rate Cuts and Early Movers

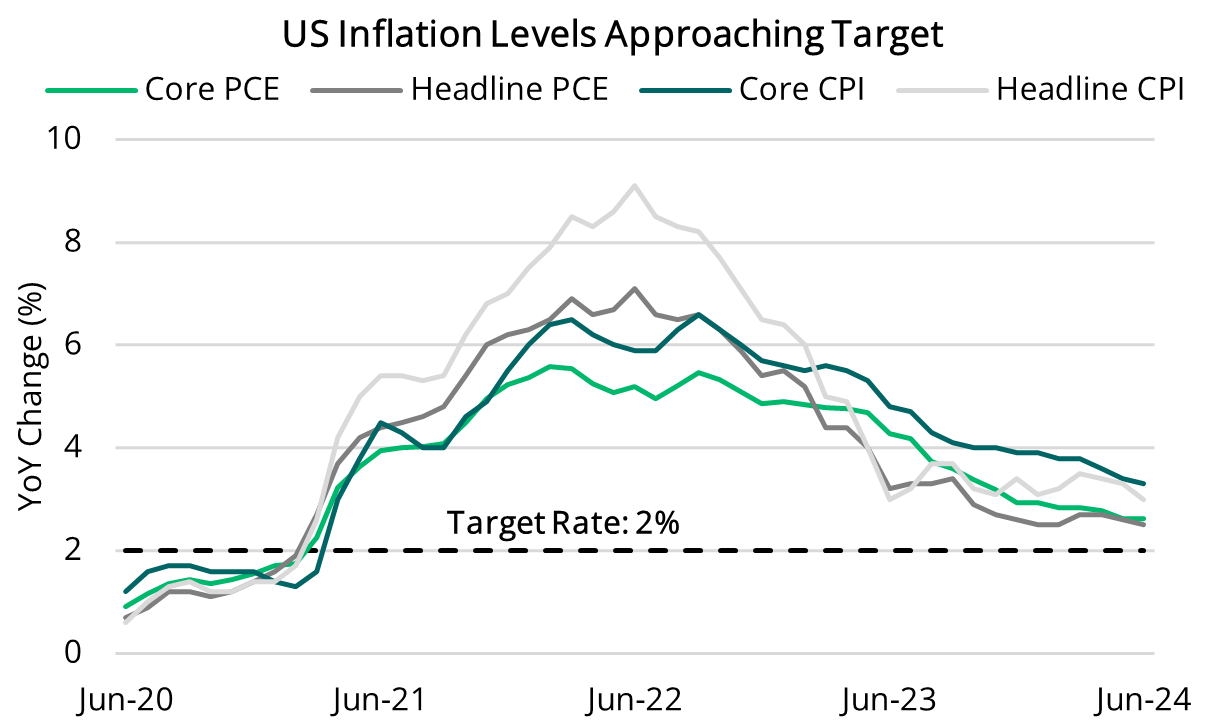

With increasing confidence that inflation is on a downward trajectory and cooling labor market conditions—evidenced by continued decreases in wage growth and a modest rise in unemployment—we anticipate that the US may see its first rate cut at the September meeting with a high likelihood of another cut before year-end. While the Fed appears poised not to be a follower of global peers, the Bank of Canada (“BoC”) and the European Central Bank (“ECB”) have already acted as early movers by implementing rate cuts. Since June, the BoC has reduced rates by 50 basis points to a current rate of 4.5%, while the ECB has cut rates by 25 basis points, bringing its rate to 4.25%. This week, the Bank of England (“BoE”) followed suit and announced a 25-basis point cut, reducing its rate to 5%.

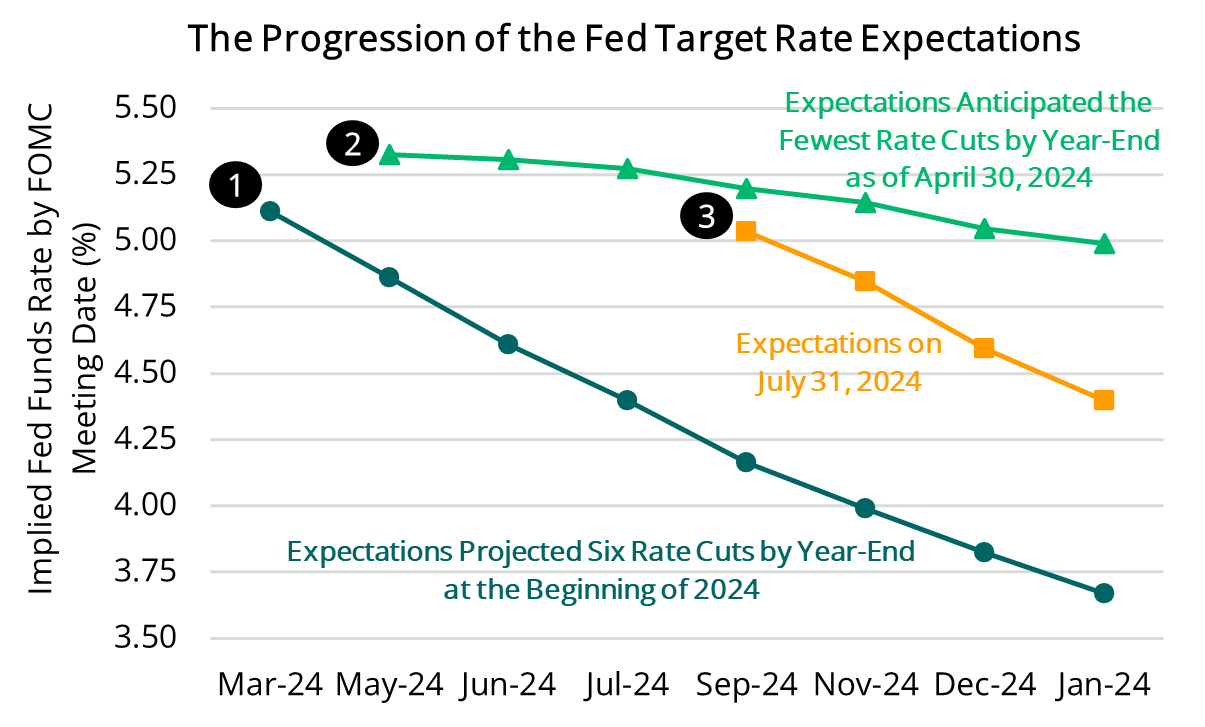

Market expectations for US rate cuts have evolved significantly over the course of the year. At the beginning of the year, the market anticipated six rate cuts during 2024, but warmer-than-expected inflation readings in the spring reduced market expectations to one 2024 by late April. Since then, the continued slowdown in price pressures has contributed to the resurgence in market expectations, which has subsequently risen to approximately three rate cuts by year-end 2024. While this expectation aligns with the Fed’s Summary of Economic Projections (“SEP”) from March, the Fed’s recent SEP indicated the median view for year-end rates shifted up from 4.6% to 5.1%, suggesting a much more conservative view as of the prior FOMC meeting in June.

Implications for Commercial Real Estate

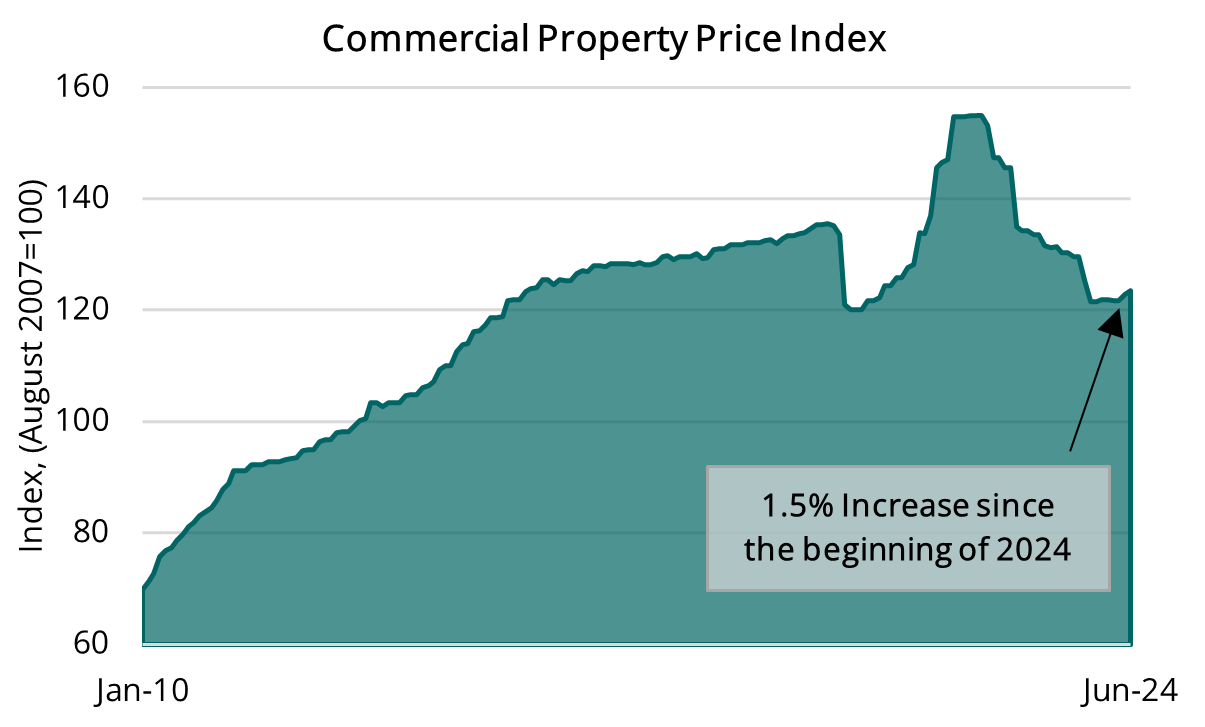

In the current Commercial Real Estate environment, we may be approaching the bottom of the decline in property values, with varying degrees of impact across sectors (see accompanying visual). Although anticipated rate cuts are expected to increase capital market activity, values are unlikely to reset to prior peak levels in the near term. The recovery of asset values will however range broadly across sectors, and in some cases create attractive entry points from a basis perspective. Each CRE sector nonetheless faces a combination of headwinds ranging from uncertainty around the fundamentals of demand, elevated near-term supply, and higher expenses, adding some uncertainty to the outlook for property values. However, we believe that select sectors and strategies are insulated from these challenges due to unique secular and structural characteristics.

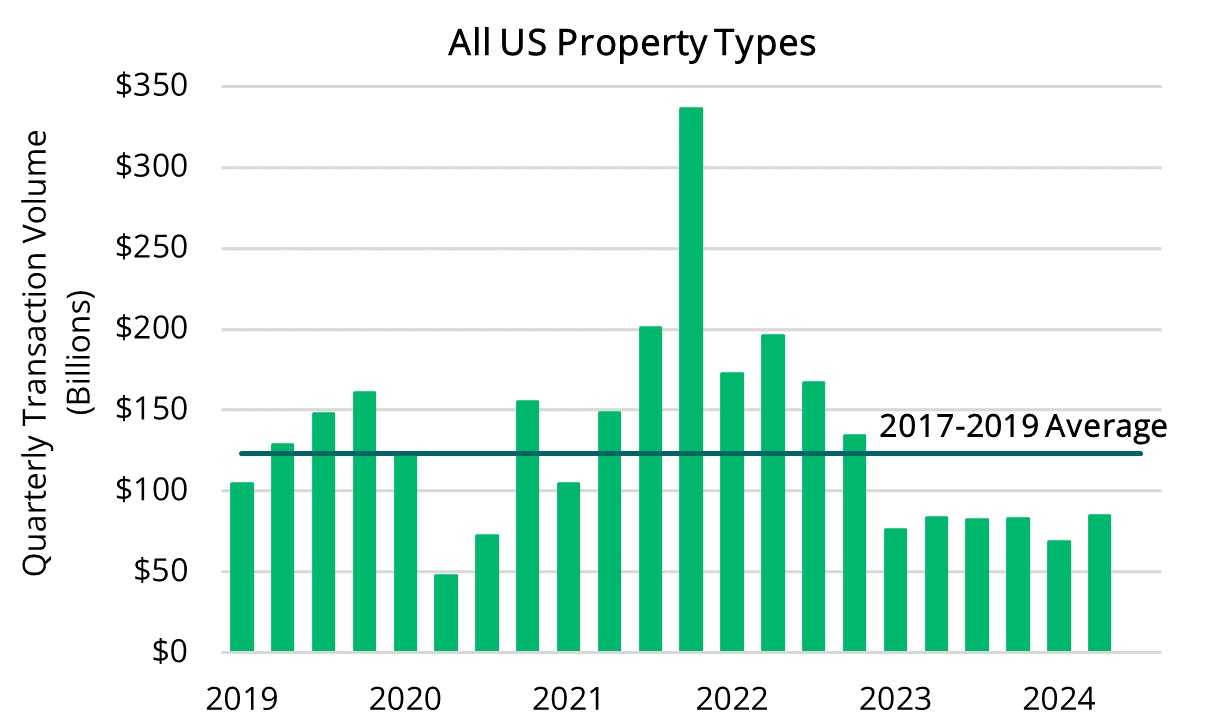

Furthermore, transaction volumes have been subdued over the past two years, averaging around $80 billion per quarter since early 2023, compared to the pre-pandemic quarterly average of $123 billion from 2017 to 2019 (see accompanying visual). With transaction activity expected to pick up following the anticipated rate cuts, going forward we are optimistic about an increasing pace of capital market activity, though we acknowledge that the recovery will be gradual.