This Week’s Developments in the US Economy

Ready, Set, Hold

Last week’s Fed meeting was largely a non-event for markets as policymakers held interest rates steady as expected. Unlike central banks in other regions responding to economic strain, the Fed is in a wait-and-see mode, with further rate cuts contingent on further inflation progress or potential labor market weakness.

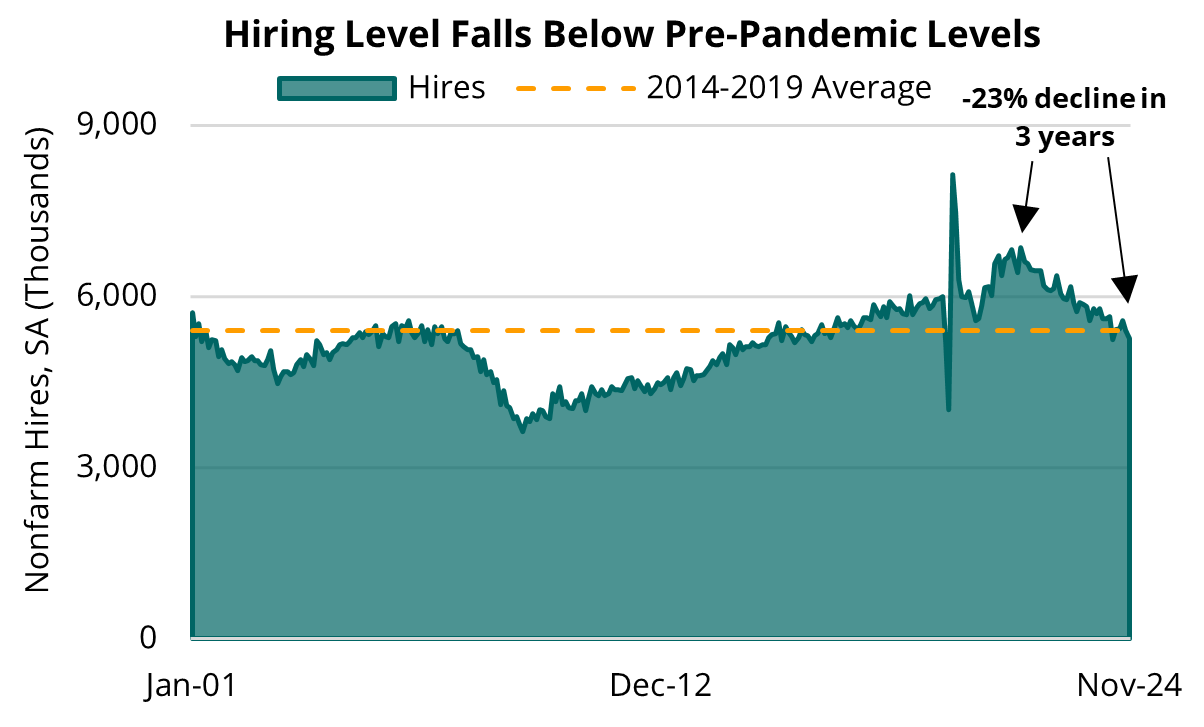

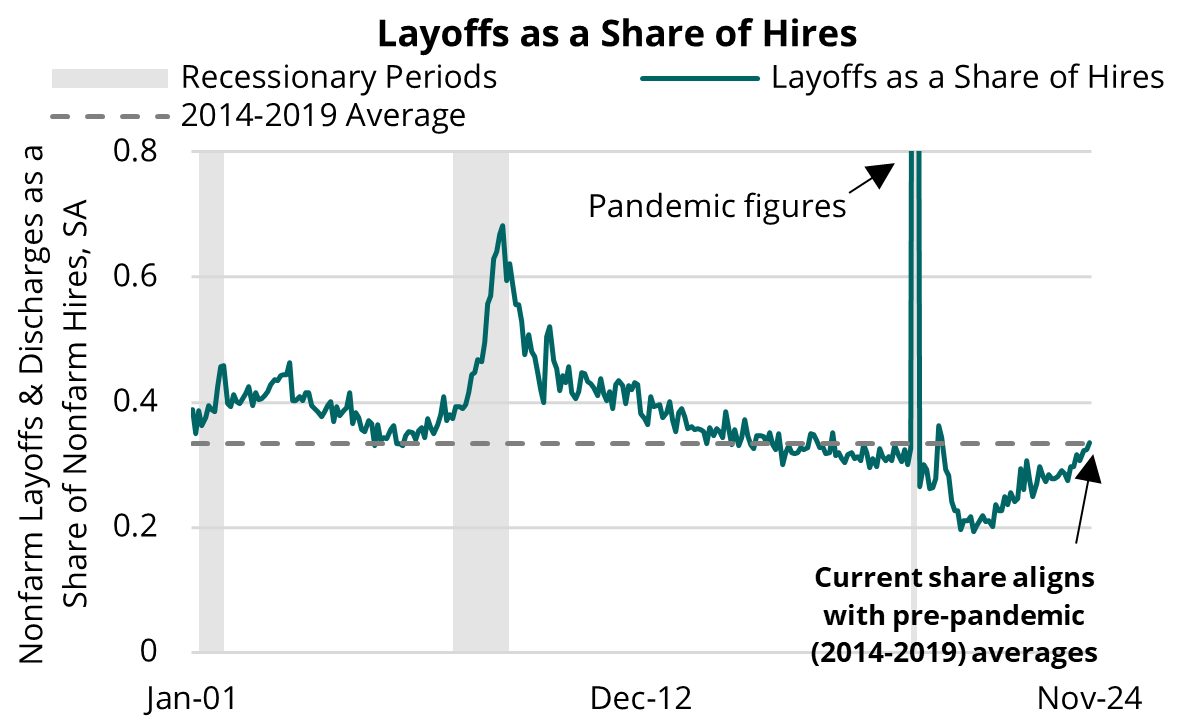

While the labor market remains strong, hiring has slowed by nearly one-quarter over three years, raising concerns that a rise in layoffs could quickly push up the unemployment rate. Inflation remains a challenge, particularly with tariffs on China taking effect and potential tariffs on Canada and Mexico pending. The Fed is closely monitoring these risks—alongside immigration policy, fiscal and policy regulation—as a combination of these factors could meaningfully impact growth and inflation.

Fed Chair Powell acknowledging the difficulty of forecasting beyond a few months, stating uncertainty is rising in both directions, making it critical, in our view, to monitor the Fed’s outlook and any signs of forward guidance to assess the path of interest rates and the implications for the investment landscape.

Where We Are Currently: The Fed's Hold Amid Global Rate Movements

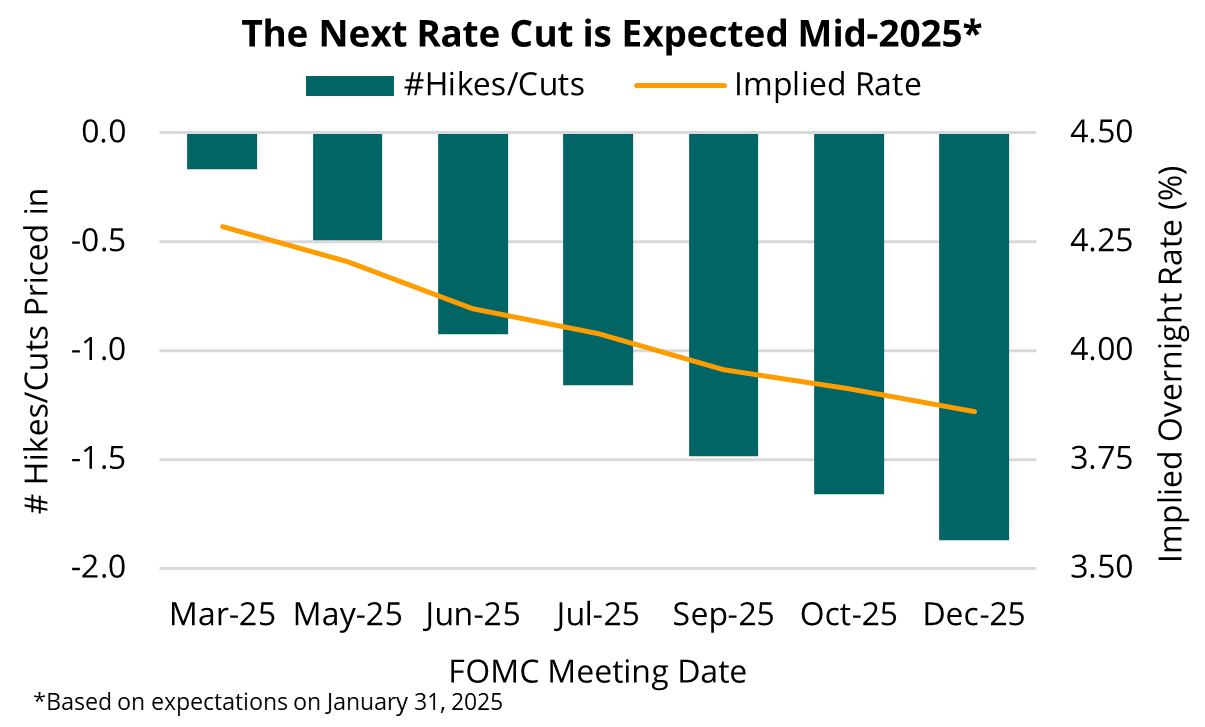

Last week, the Fed held the federal funds rate steady at 4.5% following three cuts totaling 100 bps in 2024. Meanwhile, central banks like the European Central Bank (“ECB”) and Bank of Canada (“BOC”) have cut five and six times, respectively, since their hiking cycles began.

Why isn’t the Fed following suit? In large part, some regions seeing interest rate cuts have either met their inflation targets or are grappling with weak growth (or both, in some cases). The ECB, for instance, lowered rates by 25 basis points last week as sluggish growth concerns now outweigh inflation fears. In contrast, US inflation remains above target, keeping the Fed focused on its price stability amid other signals of strength in the economy and labor markets.

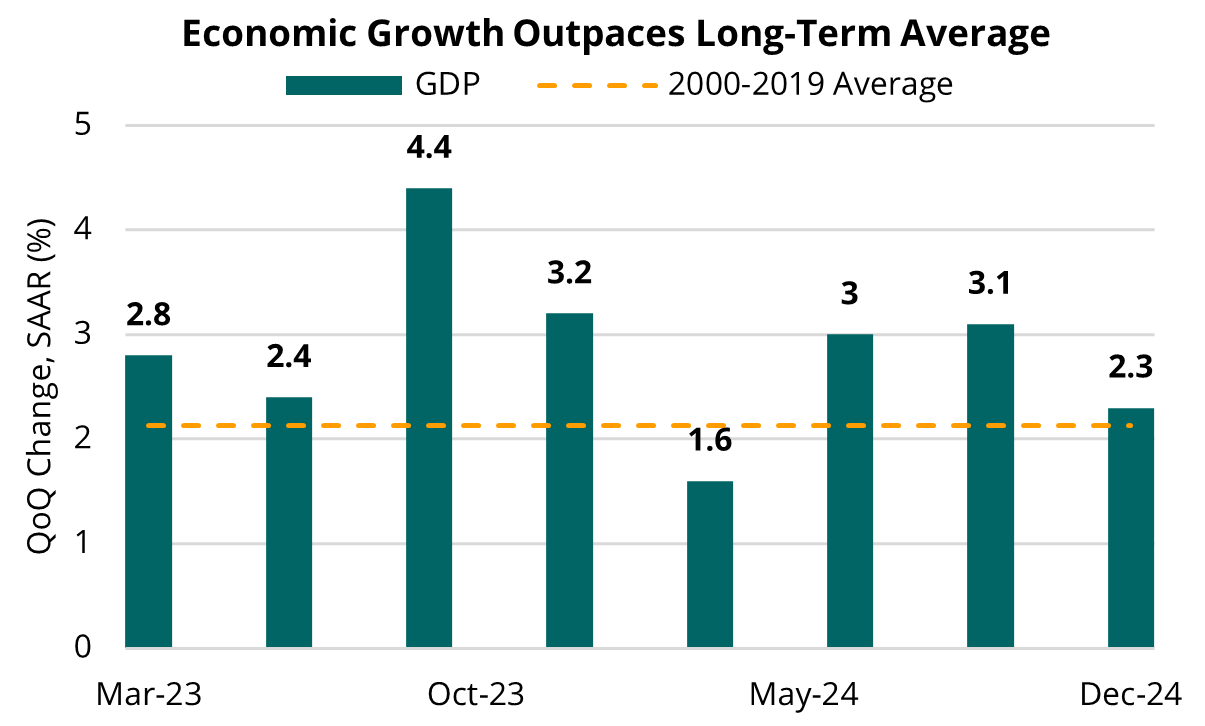

The US economy remains stable, with Q4 2024 GDP growth at 2.3%, slightly below expectations but above the 2000-2019 average of 2.1%. The labor market remains balanced, nominal wage growth has slowed, and the jobs-to-workers gap has narrowed. However, the Fed remains cautious insofar that lower hiring levels could quickly translate into higher unemployment, potentially prompting a policy response.

Key Downside Risks

With uncertainty increasing in both directions, the Fed is monitoring several downside risks, including tariffs, immigration policy, and fiscal and political regulation. Rather than any single factor, a combination of these could shape the outlook. Given that many policies are still in flux, the Fed remains in a wait-and-see mode to assess their full effects.

Tariffs

Higher tariffs could push up consumer prices, adding inflationary pressure and potentially delaying Fed rate cuts. If rates remain elevated or increase, we anticipate slower economic growth and decreasing consumer activity.

Immigration policy changes

Reduced immigration and increased deportations could shrink the labor force and weaken demand, which could dampen economic growth in the near-term.

Regulatory uncertainty

Shifting fiscal and political policies—such as tax changes or increased regulation—can complicate business planning, disrupt investment, and increase market volatility.

Positives Within the Outlook

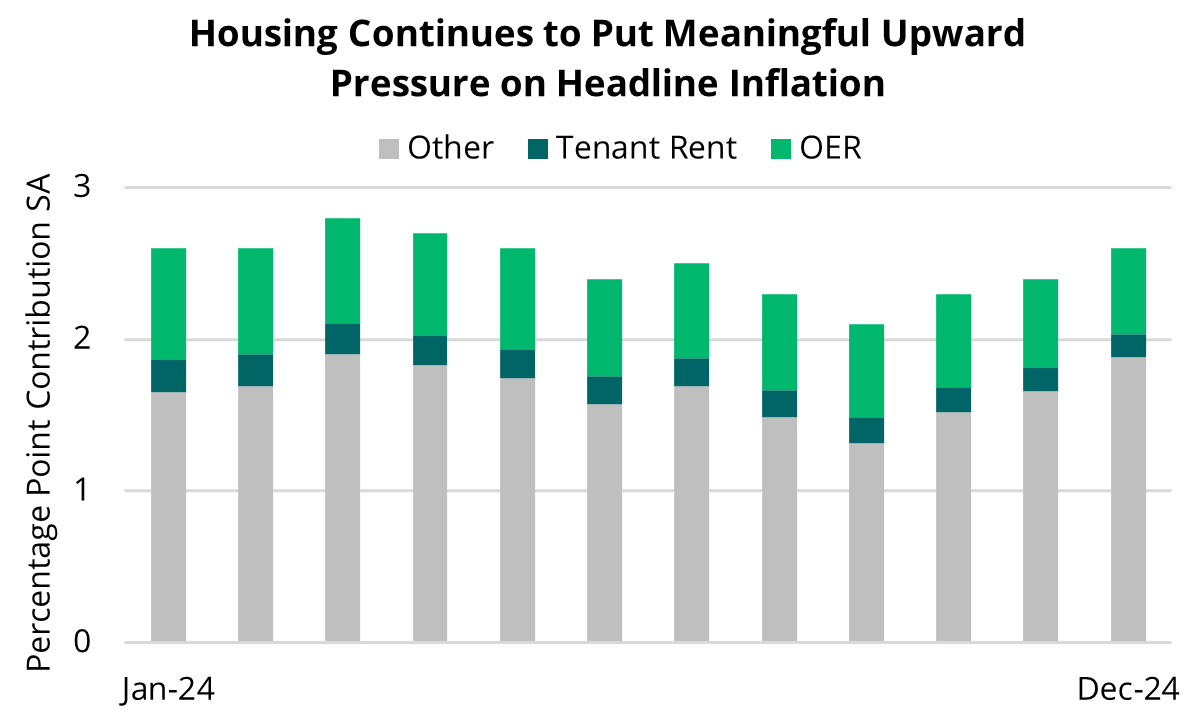

Despite these risks, the Fed expects further progress on inflation, particularly as housing costs ease. Chair Powell has emphasized that declining Owner’s Equivalent Rent (“OER”) is critical to bringing inflation down to the 2% target.

As of December 2024, housing services contributed 0.7 percentage points to headline Personal Consumption Expenditures (“PCE”) inflation and 0.8 percentage points to core PCE inflation. To reach the 2% target, housing's contribution would need to fall to around 0.1 percentage points or less—assuming other components of inflation remain stable.

What to Expect from the Fed Going Forward

The Fed is likely to hold rates steady unless inflation falls further or labor market deterioration warrants policy easing.

We believe that the upcoming FOMC March Summary of Economic Projections may offer limited clarity, as both the dot plot and the growth outlook might not provide definitive policy signals. Markets are currently pricing in one rate cut in the middle of the year and another at year-end. While the Fed is committed to its 2% inflation target, rising uncertainty makes timing and magnitude of further cuts challenging to assess, which reinforces the need for hedging against risks in today’s volatile environment.